1. Putting it off until the guilt drives you crazy.

Basic Bookkeeping and procrastination go in hand in hand for many SMBs. Mainly, that’s because the business owner, that’s you, is usually still learning how to work balance sheets. Understandably, you don’t want to mess up your books. Consequently, you keep putting it off.

A major disadvantage comes your way due to such procrastination. You also miss out on the important tax deadlines. And, when finally, you do sit down with the books, reconciling records from several months before makes the job even harder.

2. Neglecting to save receipts under $75.

Indeed, the IRS doesn’t ask for them. However, if you keep throwing out the

under-$75 receipts, you do your books no favor. They also take away your chance at providing backup documentation for various deductions you could claim. Moreover, you’ll need them in the case of an audit.

Use a digital accounting program that allows you to snap a picture of such

receipts. Then link them with the appropriate register entry. Don’t want to mix those up with the larger expenses? Simply, use one of these third-party apps to do so.

3. Writing off major purchases as immediate expenses.

This one comes under serious Accounting Mistakes to Avoid. Take, for instance, the supply of printer papers and other similar items. You pick up a $250-worth bundle from your local office supply store. You know you’ll be replenishing soon, too. Thus, you should log this purchase under office supplies when you write it off.

Unlike the papers, if you get a printer, you won’t be logging its purchase in the same way. Even if they cost the same, the latter purchase has a longer lifespan. In other words, it is now an asset. Like all assets, it is going to depreciate over time.

4. Failing to track reimbursable expenses.

Keep doing this, and it’s like flushing your money down toilets! Aside from the wastage of money, you are also saying goodbye to tax deductions. Why do that when there are many expense-tracking apps that can help you monitor those? Ideally, track such expenses when you accrue them. Just like you create a paper trail for audits by smaller receipts, tracking reimbursable expenses allows you to scope out the financial health of your business.

Learn More About Our Quickbooks Cleanup Services

5. Neglecting to reconcile or not reconciling bank accounts.

Bookkeeping Errors that DIY-ers will often include this one. Truthfully, this is a complicated job that only experienced bookkeepers should attempt.

Anyway, why is it so important? Because it’s crucial to determining your financial health! After such a reconciliation, you’d know:

How much money the business has at all times

Discover bank errors, preventing them from becoming major problems

6. Mis/Over/ Improper categorization of expenses.

Another critical bookkeeping step because it can create much confusion if not done properly. Some business owners will prompt this chaos by creating duplicate. If your books are a chaotic mass due to this habit, call in a professional!

7. Always going down the cheapest Basic Bookkeeping route.

At times, frugality will cost you money, instead of saving it for you! That is

certainly true for when companies think hiring a quality accountant is a luxury. You cannot substitute the skills of a professional with what a cheap bookkeeper brings to your project. Select moderately-priced items. Or, when buying furniture, software, or equipment, do so during a sale. But don’t think being cheap will help you when it comes to bookkeeping expertise.

8. Neglecting sales tax

Any oversight in this case, such as not reporting sales tax, entering incorrect data, overstating sales taxes due to you, could result in two things. One, you might have to pay significant fines and penalties. Or, you could keep paying more than you have to!

9. Petty cash nonchalance

Basic Bookkeeping experts advise that companies have a dedicated custodian for managing and approving petty cash-purchases. Limit potential abuses, thefts, and frauds when you appoint one. Ask anyone carrying out such purchases to bring in

an accompanying receipt. Only refill an exhausted petty cash fund by writing a check. In short, create paper trails and accountability for smoother tax seasons.

10. Trying to do it all yourself

You shouldn’t be involved in money management. As a business owner, there are many other things that vie for your attention. Thus, delegate the handling of your books to a professional. They will prevent and catch errors while freeing you up to do those other important things.

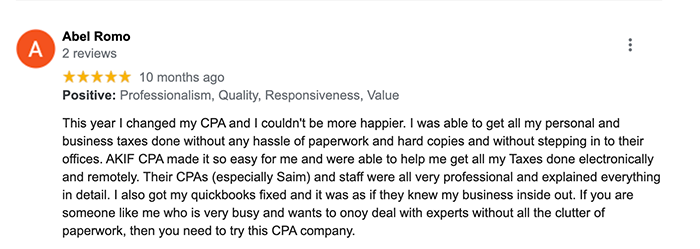

In any case, you should only attempt Basic Bookkeeping if you come from a strong accounting and business tax law background. Contact AKIF CPA bookkeeping wizards for cleaner, leaner, and accurate books!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances. Akif CPA will not be held liable for any problems that arise from the usage of the information provided on this page.