You asked and we delivered! We are now launching Cross-Border Client Stories!

In today’s case, we will discuss a unique cross-border client situation involving a Canadian citizen relocating to the United States. This person wants to forward their investment accounts, their TFSA, FHSA, RRSP, and crypto.

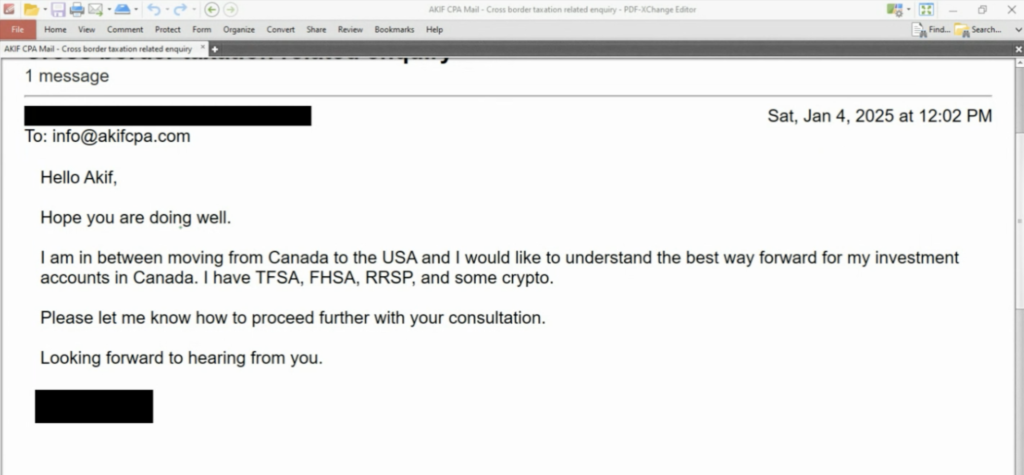

The Email:

Watch the Video

Before diving into the questions, let’s discuss some key issues with this case.

Issues:

🚩 Issue #1: What Happens to Canadian Investment & Retirement Accounts?

Moving to the U.S. means your TFSA, RRSP, FHSA, and even crypto accounts could be taxed differently. Some accounts remain tax-free in Canada but become taxable in the U.S. Understanding these rules is crucial before making the move.

🚩 Issue #2: Complex First-Year Tax Filings

The year you move is the trickiest tax year—you’re wrapping up taxes in Canada while starting in the U.S. Many Canadians make the mistake of using separate accountants for each country, which leads to errors, missed forms, and costly penalties.

🚩 Issue #3: Lack of Tax Planning Before Moving

Most people move first and think about taxes later—but that can lead to extra taxes, more reporting, and higher accountant fees. Proper planning before the move can help minimize taxes and reporting headaches.

Analysis:

What Happens to Your Canadian Investment & Retirement Accounts?

If you hold accounts like TFSA, RRSP, FHSA, or even cryptocurrency, you need to understand how they are taxed when you move. While some accounts remain tax-free in Canada, they may no longer enjoy the same treatment in the U.S.

- TFSA: Although tax-free in Canada, it is not recognized as tax-free in the U.S. Any income (interest, dividends, capital gains) must be reported and taxed annually. Some firms may classify it as a foreign trust, leading to additional reporting requirements.

- RRSP: Generally, RRSPs are not taxable upon departure from Canada, and the U.S. allows tax deferral if reported correctly. However, withdrawals may be subject to different tax rules in both countries.

- FHSA: This new home savings account has no immediate tax consequences when you leave Canada, but non-residents cannot contribute or use it tax-free for a home purchase. Withdrawals may be subject to a 25% withholding tax.

- Crypto & Non-Registered Investments: These are subject to Canadian departure tax, meaning they will be taxed as if sold at fair market value on your exit date. Any U.S. tax on future gains will depend on when and how you sell them.

🔑 Solution: Before moving, review your accounts with a cross-border tax specialist to determine which should be closed, restructured, or maintained.

The Importance of Pre-Move Tax Planning

Many Canadians move first and think about taxes later—a costly mistake. Without planning, you might face:

- Higher taxes due to missed deductions or improper structuring

- Additional reporting requirements that could have been avoided

- Expensive professional fees to correct mistakes after the fact

🔑 Solution: Work with a cross-border tax expert before you move. The right strategy can help you:

✅ Minimize taxes on departure from Canada

✅ Reduce unnecessary reporting obligations in the U.S.

✅ Structure your investments efficiently to avoid double taxation

Complex First-Year Tax Filings

The year you move is the most complicated tax year—you need to wrap up your Canadian tax obligations while starting your U.S. tax journey.

Many Canadians make the mistake of using separate accountants for each country. However, Canadian accountants often don’t understand U.S. tax rules, and U.S. accountants aren’t familiar with Canadian investment and retirement tax treatment. This can result in:

- Missed tax credits & deductions

- Errors in reporting foreign assets & income

- Severe penalties for missing forms like FBAR or Form 8938

🔑 Solution: Hire a tax professional who specializes in cross-border taxation. The right advisor can ensure:

✅ Proper reporting of Canadian assets in the U.S.

✅ Compliance with both CRA and IRS tax laws

✅ A smooth transition with no costly surprises

Final Thoughts: Don’t Wait Until Tax Time

If you’re planning to move to the U.S. or have recently relocated, proper tax planning is essential to avoid unnecessary taxes, reporting burdens, and penalties. Taking proactive steps now will save you time, money, and stress in the long run.

📩 Need expert guidance? Email info@akifcpa.com to get a personalized tax strategy in place. We specialize in cross-border tax planning for individuals and businesses so you can make your move with confidence.