Part 1: U.S. LLC For Canadians Doing Business in the U.S. — Good or Bad?

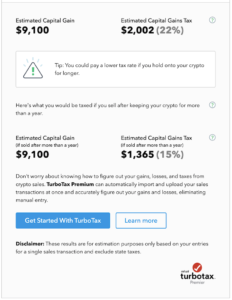

Reading Time: 3 minutesIs it a good idea or a bad idea to have an LLC if you are a Canadian doing business in the U.S? Be aware of double taxation, the Branch Profit Tax, and the fact that the IRS and CRA categorize LLC income differently.