The Crypto market is getting a boom with each coming day. With more money and people circulating in its fields, the IRS has incorporated regulations to ensure cryptocurrency holders, traders, and miners are taxed accordingly.

The IRS has listed different sets of rules and regulations to determine crypto as a taxable event.

If you feel interested in reading those regulations, here is the detail for crypto-taxes rules.

Let’s start here from its basic rule – any gain and loss you make on your crypto is a taxable event.

Understanding Capital Gains & Cryptocurrency Taxes

Let’s say you purchased a cryptocurrency like Bitcoin. It’s the first of the month, you got your first salary and bought Bitcoin for $30,000. This (at the time of our publication) equalizes to the 1-BTC coin.

The next day, you got yourself up from your amazing sleep and your 1-BTC has gone up by $32000. Congratulation, you received a gain of about $2000.

This gain is called a Capital Gain. You got a capital gain of $2000, and that capital gain is taxable income under IRS rules.

Moreover, this capital gain (or loss) is even further divided into:

- Short-Term Capital Gains: holding crypto for less than one year

- Long-Term Capital Gains: holding crypto for more than one year.

Short Term Capital Gains are usually referred to as gains you made in less than one year while Long-Term Capital Gains refer to the gains you made in more than one year.

Furthermore, this capital gain is not limited to crypto trading, but it’s also counted for other purposes as well. Your Crypto capital gains will be combined with other capital gains to calculate your tax burden.

Some of the Capital Gains Taxes Are Listed Here:

- Selling Crypto for Real Money

Let’s suppose you bought a Bitcoin for 10,000 and sold the same quantity of Bitcoin for 12,000. This counted as capital gain, and you are liable to pay taxes. - Selling one crypto to buy another one

Let’s suppose you bought 1-Bitcoin for 20 ETH and then sold the same 1-BTC for 30 ETH. This will also be considered as capital gain and you will be liable to pay taxes. - Using Crypto to buy Goods and Services

If the value of the cryptocurrency has gotten increased at the time you were exchanging it to buy goods and services, this is also a taxable event.

There can be other multiple scenarios that fall under capital gains, the best way to interpret such scenarios will be to discuss with a crypto accounting expert CPA.

Understanding Income Tax Payment

Other than capital gains and their liable taxes, crypto income is also a taxable event.

Here are some general income taxes you need to know:

- Receiving your salary in crypto as you receive in Fiat currency (regular USD for example)

- Getting crypto using mining processes

- Getting crypto using Hard forks and Airdrops

These are the very general explanations. For details, we’d recommend reading a complete list of IRS rules for which cryptocurrency is considered under income tax, or talking with a CPA who understands crypto regulations.

Steps to follow for Calculating Crypto Taxes

We have divided crypto taxes into two categories:

1) Capital Gains

2) Crypto Income Taxes

1 – Calculate Your Cryptocurrency Income Tax

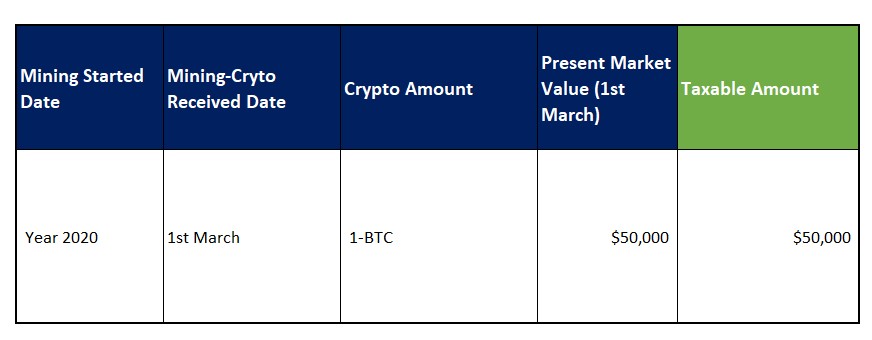

The first and immediate step you need to do while working on calculating your crypto taxes is checking the market value (equal to fiat currency) when you initially receive the coins.

For example, you started mining one year ago. As a result, you got a 1 BTC on the 1st of march. Let’s suppose, on this specific day of 1st march, 1 BTC was equal to $50,000 in market price. So, your crypto will be taxable for the worth of $50,000.

In simple terms, every time you sell crypto in the market, you are supposed to equalize it with the present fiat currency of the market. Once compared, you are liable to pay tax on that amount.

However, other than crypto income tax, you are also supposed to pay crypto capital gain tax as well.

2 – Calculating Capital Gains

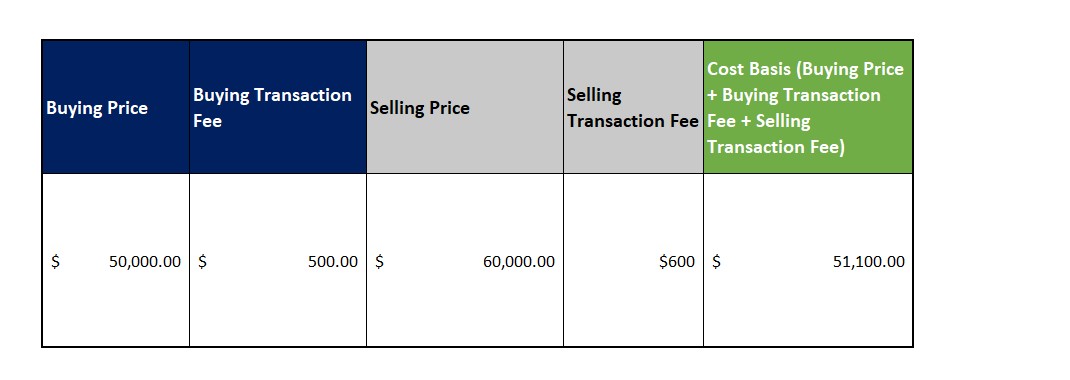

Capital gain and capital loss aren’t gained by subtracting buying price from selling price. You need to count cost basis as well.

What is a cost basis, it’s the amount you paid for buying any crypto plus any transaction fee as well.

Cost Basis = Crypto Market Value + Transaction Fee

Let’s suppose you bought 1 BTC and it has a market value of about $50,000. While making a buying transaction, you paid a transaction fee to your exchange as well. Let’s assume, it takes 1% (which becomes $500 in this case) of your transaction fee.

So, the total cost you paid for buying 1 BTC is $50,500.

After some period, you decided to sell the crypto in the market. You again have to pay a transaction fee in the market while making a sale. Suppose you sold it for $60,000 and the transaction fee is 1% (which becomes $600 in this case).

In total you paid this amount to trade crypto:

Coin Value ($50,000) + Buying Transaction Fee ($500) + Selling Transaction Fee ($600) = $51,100

This amount ($51,100) is also known as Cost Basis.

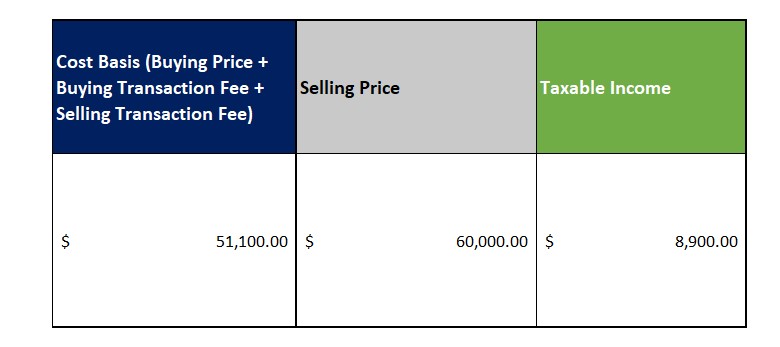

To calculate capital gains, we need to subtract the Cost Basis from the Selling Price. Capital gain in the above scenario will be:

Cost Basis ($51,100) – Selling Price ($60,000) = Capital Gains ($8900)

In the above example, $8900 is a taxable amount.

Cost basis becomes complex and complex when you sell and buy multiple cryptos throughout the year. To get a broad overview of the cost basis, please get yourself informed about its different methods.

Please note taxing capital gains also vary from country to country and by different cases as well. It’s always advisable to take advice from a credible crypto CPA before filing any of your crypto taxes.

Different Software to use for Crypto Tax Calculations and Accounting

When you deal to try to trade cryptocurrency multiple times, accounting and taxation become a little complex as well. To help us go through these procedures, the market offers several crypto software to deal with the problems. You can see our full list here: crypto accounting software.

Software Name | Starting Price | No. Of Transactions | Free Trial |

Koinly | $0 | Free 10,000 | Yes |

CryptoTrader.Tax | $49 Per Tax Year | Starts at 100 | Yes |

TokenTax | $65 Per Tax Year | 30,000 (VIP) | No |

Accointing.com | $0 | 50,000 (Pro Plan) | Yes |

Zenledger | $0 | Starts at 25 | Yes |

BearTax | $10 | 25 (Cheap Plan) | Yes |

CryptoTax | $49 | 100 (Cheap Plan) | Yes |

Frequently Asked Questions About Crypto Tax

We have a complete dedicated list of cryptocurrencies taxes FAQ, however, we added some relevant questions here as well.

Feel free to ask any question related to your crypto taxes.

Here are some of the forms to file taxes.

To report capital gain/loss, use Form 8949 and Form 1040.

To report ordinary income, use Form 1040, Form 1040-SS, and Form 1040-NR.

It is also important to mention that these broad rules to go after, please contact a reliable CPA before filing any taxes.

Once you trade, sell, pay and exchange crypto for any purpose, you should calculate your gain and loss.

The short and simple answer would be “No”. It’s NOT a taxable event.