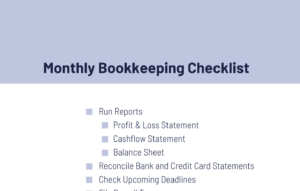

Monthly Bookkeeping Checklist

Reading Time: 2 minutesBelow you will find a list of recommended monthly bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to

All of the information you need, right here, right now.

Reading Time: 2 minutesBelow you will find a list of recommended monthly bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to

Reading Time: 3 minutesIf you are a business owner, then you have to pay your employees. This means that you have to worry about payroll taxes. These taxes

Reading Time: 4 minutesWhether it’s issuing invoices, logging expenses and reconciling bank statements, or identifying errors, bookkeepers play a critical role in the success of any business. Many

Reading Time: 3 minutesAs business owners face more and more pressure to sustain through a shaky economy, many are realizing their current bookkeeping strategy is not longer tenable.

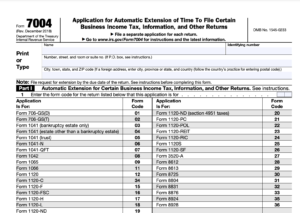

Reading Time: 3 minutesAn important note: depending on the type of extension you are looking to file, you may need to submit additional forms. We highly recommend speaking

Reading Time: 4 minutesAccording to the IRS Revenue Ruling 2012–18, tips and service charges are two different things that have their own tax implications. To compensate employees and

Reading Time: 5 minutesAll companies need to comply with the standard regulations set by the regulatory institutes. For example, financial statements must be made in accordance with the

Reading Time: 5 minutesMost business owners try to use Excel rather than true accounting software like Quickbooks to save costs. However, nearly every business owner reaches a point

Reading Time: 2 minutesThe break-even point is defined as a limit when the overall costs and total revenue are equal. In simple terms, when the business is neither

Reading Time: 4 minutesPeople often confuse themselves between payroll and Income tax. Both are employment taxes but differ in various ways. Income tax is paid by employers whereas

Reading Time: 4 minutesA CPA provides expertise in the financial industry. Businesses often hire them to manage tax planning, financial forecasting, and defending any issues in front of

Reading Time: 3 minutesThe short explanation lies in the statement all CPAs are accountants, but not all accountants are CPAs. While it’s easy to get the two confused,

Reading Time: 6 minutesEmployee classification ultimately affects how you issue payroll. Each team member will be paid differently depending on whether they are a full-time or part-time employee,

Reading Time: 3 minutesWhether you work with a CPA who provides you with monthly and annual statements, have an in-house accountant or bookkeeper, or are an individual engaged

Reading Time: 4 minutesEach tax season, many business owners and individuals discover they owe the IRS late filing penalties and/or late payment penalties. But, more often than not,

Reading Time: 5 minutesFiling your tax returns can be a very overwhelming process. The situation can add to the complexity when you file an extension for your tax

Reading Time: 4 minutesWith the right tax strategy, your business can avoid paying a sizable sum of taxes to the government. Companies that heavily invest their thought processes

Reading Time: 8 minutesCNBC, in 2021, published a report talking about how businesses reduced their costs by getting back billions of dollars from the government. On August 2022,

Reading Time: 4 minutesCompanies prepare monthly financial reports to monitor their operations closely. These reports can provide early warning signals to revenue accounts or expenditure accounts that are

Reading Time: 6 minutesWith the year coming to a close, interest rates shifting, and layoffs hitting the tech industry, the turn into 2023 is proving uncertain as ever.

Reading Time: 6 minutesAccording to the IRS, Incorrect payroll filing penalties have affected 40% of small to midsize enterprises. Payroll errors are, unfortunately, common, and the resulting penalties

Our CPAs build an accounting process that is modern, efficient, and has the reporting capabilities you need.

Regular reports ensure you get the oversight you need to be comfortable, without being involved in the day-to-day.

Easily submit any documents remotely through our secure online portal, and we’ll take it from there.

We believe in building strong, long-term client relationships, holding ourselves to a high standard of accountability when it comes to client work, providing excellent communication, and receiving ongoing feedback from our clients.

With unparalleled guidance, cost-saving entity structures, and forecasting built on experience, you’ll get the benefit of CPAs that know the ins and outs of how your industry works.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

Maintain a complete picture of your transaction history and financial health. Our team adheres to strict accounting standards, ensuring accurate and up-to-date books with a financial trail that is straightforward and easy to follow.

Our bookkeeping and accounting reports offer a detailed and accurate look at the complete financial health of your business. From regular reports to real-time insights, our approach to accounting is always data-driven

Unlock the full power of your accounting software with a fully-integrated software setup. Ensure regular and easy instant-generated reports with unquestionable accuracy in every line item

Regular tracking and management combined with inventory audits, evaluations, and reports help you optimize your inventory levels, track performance, and make critical decisions

Get paid on time and stay up to date with vendor payment with invoicing services focused on accuracy, timeliness, and strategy. Our team implements tools and approaches that ensure accounts payable and accounts receivable are in good health

Payroll services from the top down means your business gets the labor reports it needs while your employees and contractors are paid on time. Our team follows regulations and focuses on accuracy, offering well-rounded payroll services to the highest standard.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

For assistance in planning and transferring your U.S. assets to Canada, please contact our colleague Phil Hogan, CPA, CA, CPA at (250) 661-9417 or phil@philhogan.com