Here’s the situation: A client is pulling in $40K–$100K/month in revenue and wondering—what’s the best tax structure to maximize profits and minimize taxes? 🤔

The goal? To build a strong financial base so they can take home as much as possible while staying tax compliant. Sounds like a plan, right? But here’s the kicker—they’re in e-commerce, so we need to dive into sales tax and sales tax nexus. This is a big deal for e-commerce businesses, and we break it all down for them.

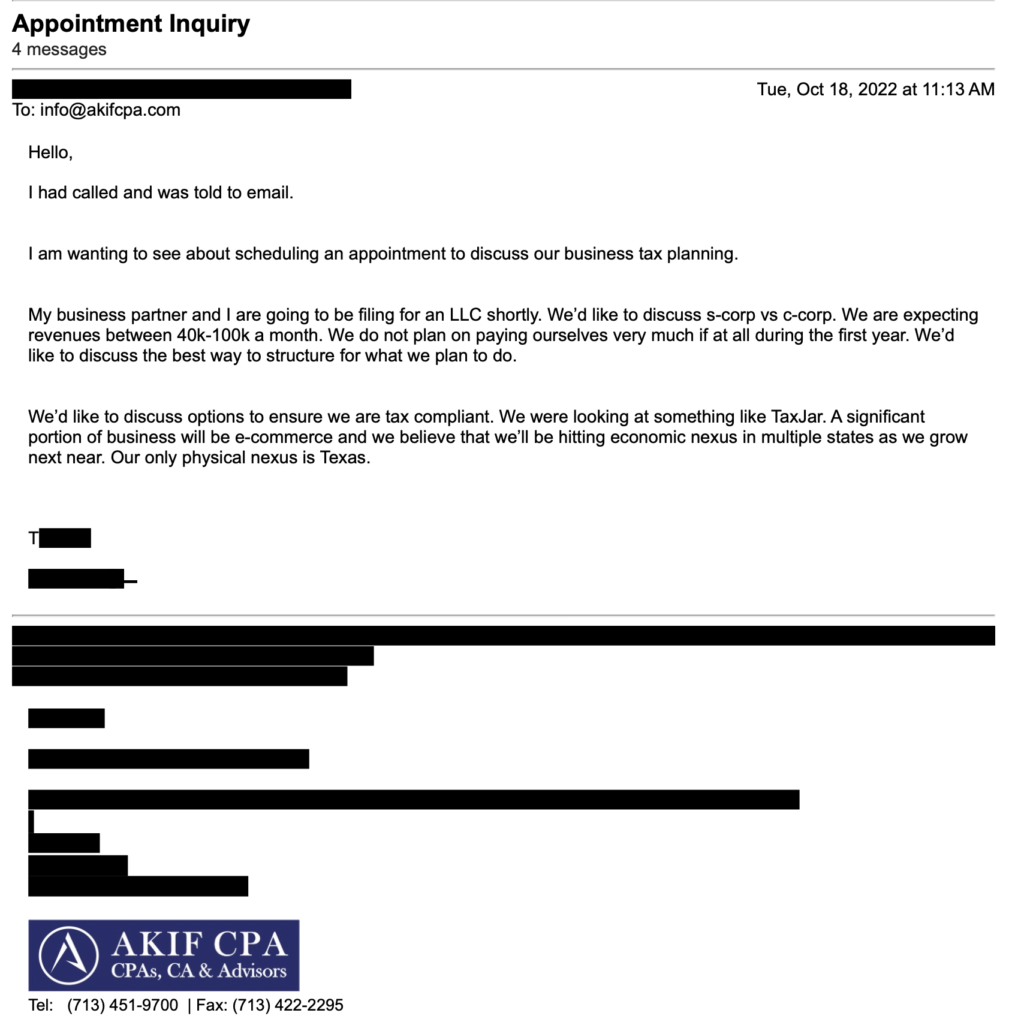

The Email:

Watch the Video

At Akif CPA, we believe that every business owner deserves tailored advice to help them make the most of their hard-earned money. Recently, we had the pleasure of working with a new client—a dynamic entrepreneur launching their e-commerce business with revenue ranging between $40K and $100K per month.

As a brand-new LLC, their primary concern was figuring out the best tax structure for their business. They were excited about their growth potential but also wanted to ensure they stayed compliant, minimized taxes, and built a strong foundation for long-term success.

Here’s how we helped:

Step 1: Choosing the Right Tax Structure

Our first task was to guide them through the maze of tax structures. We discussed the key differences between S Corps, C Corps, and partnerships, focusing on how each impacts taxes and flexibility.

For their specific goals—minimizing taxes, maximizing take-home income, and reinvesting profits—a flow-through entity like an S Corp or partnership made the most sense. These structures allow the business income to pass directly to the owners, avoiding the double taxation faced by C Corps. We also explained how careful tax planning could help them maximize deductions, ensuring they keep more money in their pockets.

Step 2: Addressing Sales Tax Nexus

Since they operate in e-commerce, sales tax compliance was a critical area of concern. We explained how sales tax nexus works—when a business sells above a certain threshold in a state, they’re required to collect and remit sales tax for that state.

To stay compliant, we recommended implementing an accounting system that tracks sales data by state. Regularly reviewing this data would ensure they could identify when thresholds were crossed and handle sales tax filings appropriately.

Step 3: Accounting and Compliance

We emphasized the importance of maintaining accurate books and records. For an e-commerce business, good bookkeeping isn’t just a best practice—it’s essential for staying compliant with state and federal regulations.

We outlined a compliance roadmap:

- Filing the correct tax forms (1120S for S Corps or 1065 for partnerships)

- Keeping track of state-specific sales tax obligations

- Conducting quarterly reviews to ensure they’re on track

The Outcome

By the end of our consultation, our client had a clear understanding of the steps needed to build a financially sound business. They left confident about their tax structure decision and equipped with a plan to track sales, stay compliant, and maximize their profits.

Your Business, Our Expertise

Every business has unique challenges, and we’re here to help you tackle them. Whether you’re launching a new venture, scaling up, or navigating complex tax issues, our goal is to guide you toward success.

If you’re ready to take your business to the next level, reach out to us at info@akifcpa.com. Let’s build something great together! 🚀