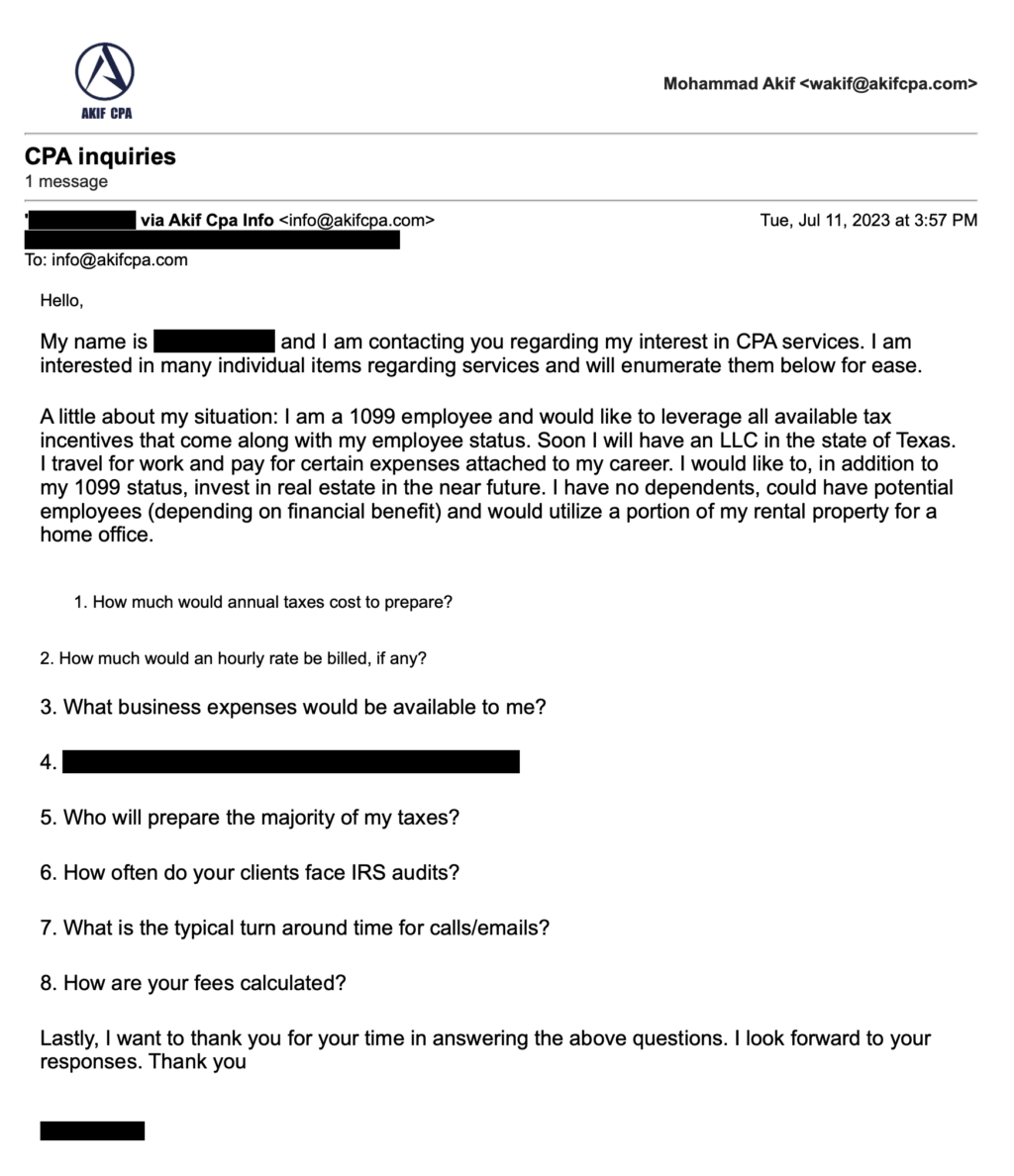

Today, we’re diving into a real client inquiry! Here’s the situation: this individual is a 1099 contractor looking to maximize tax incentives, planning to form an LLC and exploring real estate investments.

The Email:

Watch the Video

Before diving into the questions, let’s discuss some key issues with this case.

Issues:

🚩 Issue #1: Still a 1099 Contractor/Schedule C Filer (PAYING ALL THE TAXES! – yes, I’m a millennial and I still love the meme): this person is currently at a 1099 contractor, so not quite an LLC yet, and they’re not an S-Corp either. What this means is they’re getting hit with ALL THE TAXES: Federal, Social Security, Medicare, and State Taxes. That’s four types of taxes before even thinking about deductions or proper tax structuring! If your take-home pay (net income, not your revenue) crosses a certain amount, usually like $50k or $75k, it might be time to consider a different tax structure.

🚩 Issue #2: Deductions (Maximizing Tax Incentives): Is this person taking advantage of every possible deduction? Have they taken the time to learn what deductions are available or are they relying on Google/AI (I’ve tested AI on this, and I like AI it’s great, but it gave me tons of wrong information!🤯)

🚩 Issue #3: Future Real Estate Investments: Real estate is a whole different game, and the understanding around it is much different too. You need a different kind of tax structure, and we’ll have to make sure his strategy matches his goals.

Analysis:

Right now, as a 1099 independent contractor, they are not yet an LLC, and even when they become one, an LLC alone doesn’t reduce taxes. It is still a disregarded entity for tax purposes unless they elect for S-Corp or Partnership status. Without making that election, they will continue to be taxed at the maximum level—federal tax, Social Security, Medicare, and state tax (if applicable). That’s four different tax layers before considering any deductions!

🔑 Solution #1: LLC with an S-Corp or Partnership: This will help our client maximize available tax incentives. If you’re an W-2 employee making a dollar, you might be taking home around 69 to 70 cents after taxes. But if you’re a business owner with the right strategy, you could be taking home 80 to 85 cents for that same dollar. This difference can add up year after year, and it’s all because of tax planning. By making the right decisions, maximizing deductions on both the business and personal levels, you can keep more money in your pocket. That’s the key—smart tax planning means more money in your hands.

What sounds better to you?

👎 W-2 Employee: $1 = 69–70 cents after taxes.

👍Business Owner: $1 = 80–85 cents after strategic tax planning.

These small changes add up over time, giving you the potential to save more and take home more!

🔑 Solution #2: Maximize Deductions: You’ve gotta take the time to learn, understand, and maximize your tax deductions. Even if you’re a sole proprietorship, I always ask why don’t you have a 401k set up? Why aren’t you saving on travel expenses. All of our 1099 clients we send a list of deductions so they know what is available and how to get them.

🔑 Solution #3: Real Estate Investment-Specific Structure: When it comes to Real Estate, think of the LLC as the base of the home. If the foundation isn’t solid, anything built on it will eventually crumble. So, get your base right and strong—this allows you to maximize deductions. Once your foundation is set, you can build on it strategically. It’s not just about what you’re deducting for your business; it’s also about when and where to buy equipment, and how to make those purchases. And don’t forget about retirement accounts—maximizing those can save you a ton in taxes. Each strategy you use builds upon the next, creating a strong, tax-saving structure for your business. Setting up the proper LLCs and making sure you’re properly structured is key.

For some individuals, a sole proprietorship works, but if they’re netting over $50K–$75K, they should strongly consider transitioning to an LLC taxed as an S-Corp to minimize self-employment taxes.

How We Helped This Client:

- Business Structure:

- Convert to an LLC taxed as an S-Corp or explore a Partnership structure if applicable.

- Simply forming an LLC does not help with taxes—it only provides legal separation. Tax elections must be made.

- Maximizing Deductions:

- Understand how to properly track and deduct expenses.

- Learn the rules for business travel to maximize deductible expenses.

- Consider retirement plans (e.g., Solo 401k) for additional tax savings.

- Explore strategies that allow for legitimate business deductions (e.g., home office, depreciation, vehicle expenses).

- Real Estate Investment Planning:

- Real estate requires a different tax structure depending on whether the goal is long-term rental income or short-term flipping.

- Choosing the right LLC or holding structure is crucial for liability protection and tax efficiency.

Final Thoughts:

The key to financial success isn’t just making money but also keeping more of it through smart tax strategies. A proper structure helps protect assets and reduce taxes, while proactive tax planning ensures maximum deductions.

If you need personalized tax strategies, bookkeeping, or entity structuring, reach out to us at info@akifcpa.com. We’re here to help with your business and individual tax needs!