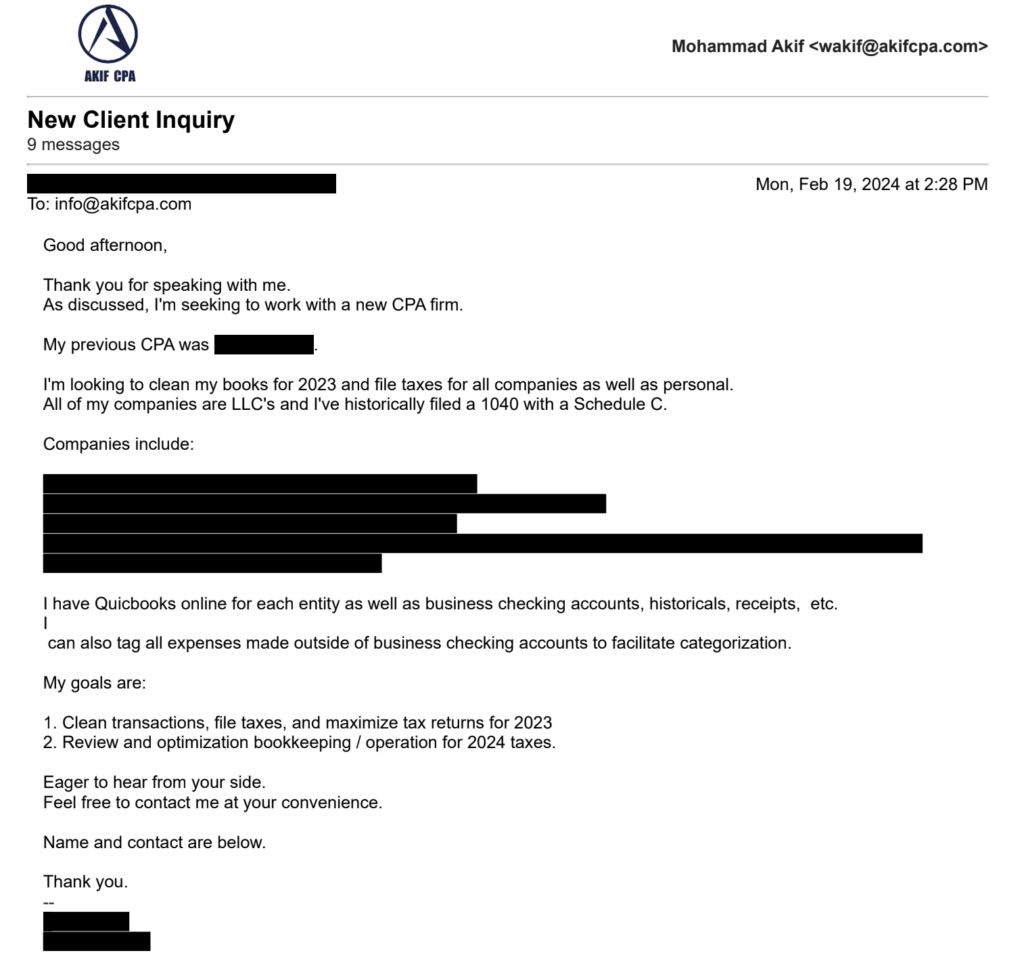

Today, we’re diving into a real client inquiry! Here’s the situation: this business owner is looking for a new CPA and needs help cleaning up their Quickbooks for multiple LLCs. They want to maximize tax returns, and optimize bookkeeping and operations for the next year.

The Email:

Watch the Video

Before diving into the questions, let’s discuss some key issues with this case.

Issues:

🚩 Issue #1: Disorganized Accounting & Bookkeeping

The client reached out needing help with cleaning up their QuickBooks, as the books were in disarray, making it difficult to move forward with accurate tax filings. If you’re doing your own accounting or relying on someone who’s not following through, it can get messy fast, and that’s where we come in to clean things up.

🚩 Issue #2: Tax Filings & Deadlines

Their tax filings were behind, and they needed assistance catching up to avoid any late penalties. The filing is important, but so is the strategy behind it. Without proper accounting, you can’t plan for taxes ahead of time.

🚩 Issue #3: Optimization for 2024

With 2023 wrapped up, the client needed a tax strategy for 2024 that would optimize their business’s financial health. This includes evaluating the business’s structure and ensuring that it makes sense for both the current and future goals.

Analysis:

Accounting Cleanup:

Our first step was to address the accounting issue—cleaning up QuickBooks and making sure that the transactions were properly categorized. This cleanup was essential not just for filing taxes but for setting up good financial practices for the future.

Filing Taxes:

Next, we had to catch up on the missed filings. Filing taxes is not just about meeting deadlines—it’s also about making the right decisions to minimize taxes. Unfortunately, the past had to be filed under the previous structure, but that’s okay! You can only move forward from here.

Tax Optimization & Future Planning:

We looked at the business structure—right now, it’s an LLC filing as a disregarded entity. That might be fine initially, but it doesn’t optimize tax savings long-term. We discussed converting it to an S-Corp and other strategies to minimize self-employment taxes.

Solutions:

🔑 Solution #1: Clean Those Books Up and Know Your Numbers!

First and foremost, it’s critical to clean up your accounting software, whether it’s QuickBooks, Xero, or another tool. If you don’t know where your business stands financially, you can’t make informed decisions. Clean books lead to accurate data, which in turn leads to better tax planning. We recommend setting up a regular cadence for reviewing your books—monthly or quarterly at the very least. Knowing your numbers will allow you to make smarter decisions throughout the year and maximize your tax savings.

🔑 Solution #2: File the Previous Year’s Taxes

The next step is to file any overdue taxes as soon as possible. While you can’t change the past, making sure that you’re caught up on filings is essential to avoid penalties and stay compliant. Filing taxes on time also allows us to start planning for next year. Once the filings are up to date, we can move on to optimizing your tax situation.

🔑 Solution #3: Restructuring the LLCs and Tax Strategy

The client’s LLCs were currently set up as disregarded entities for tax purposes, which might be costing them in taxes. By restructuring to elect S-Corp or exploring a partnership, we can reduce self-employment taxes and provide a much better tax strategy. Restructuring may not be necessary for every business, but for businesses making more than $50K–$75K in net income, it can lead to significant tax savings. The right structure, aligned with a solid tax strategy, will help the business thrive both now and in the future.

Final Thoughts:

The best way to keep more of your hard-earned money is through strategic tax planning. Having the right business structure, staying on top of bookkeeping, and maximizing available deductions can save you a ton on taxes. Remember, the more proactive you are, the more you can save!

If you’re in need of personalized tax strategies or want help optimizing your business structure, we’re here for you. Reach out to us at info@akifcpa.com, and we’ll help you get your financial game plan in shape.