View a timeline of cryptocurrency regulation and laws

Remember, things are always changing in this industry. Set up an appointment today for the latest on what’s happening in crypto, and what’s to come.

DigiCash Inc. was founded in 1989 by David Chaum. DigiCash Transactions were unique and anonymous due to cryptographic protocols developed by its founder.

photo credit: chaum.com

Bit Gold, a decentralized virtual currency, is proposed by blockchain pioneer Nick Szabo in 1998. Although it was not created, it is considered the direct precursor to Bitcoin protocol.

photo credit: bitgold.site

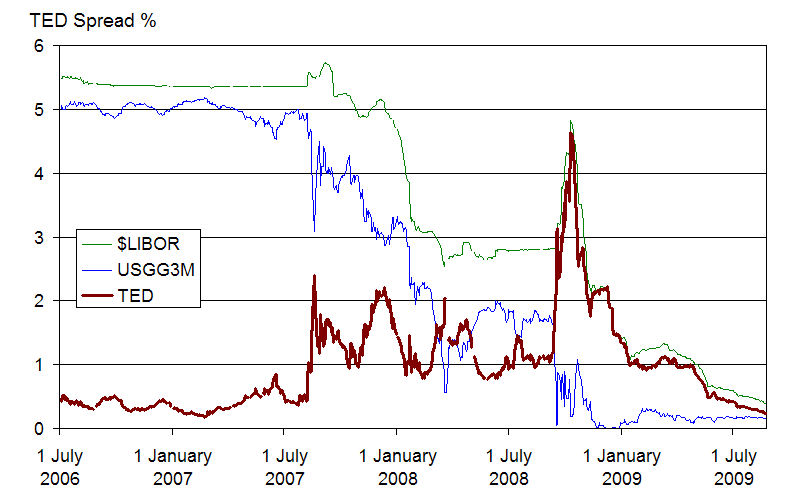

The most serious financial crisis since the Great Depression has global impact, causing a worldwide economic crisis

:max_bytes(150000):strip_icc()/bitcoin-42928b77168c4ab184312fba40ee9ae2.jpg)

Bitcoin was invented by Satoshi Nakamoto (an unknown person or group) and is introduced to the public through open-source software. It was defined as bitcoin in a white paper published in October 31, 2008, and is valued at $0.0007 in 2009.

photo credit: Investopedia

A guy buys two pizzas and pays 10,000 BTC, equivalent to $25 ($100 million in today's value)

1 BTC reaches the value of 1 US penny

In just one year, the value of 1 Bitcoin increases from one penny to $100 USD.

The IRS Issues Notice 2014-21, introducing accounting and tax compliance for cryptocurrency in the United States.

In 2018, the American Institute of CPAs (AICPA) issues a tax advocacy comment letter addressing the taxation of the digitalized economy.

photo credit: us.aicpa.org

In 2019, the IRS sends 10,000 tax notices regarding cryptocurrency.

After working with crypto clients and implementing IRS tax regulations and process, Akif CPA officially forms a Cryptocurrency Accounting and Tax team, led by Saim Akif.

The IRS issues a revision of Rule 2019-24 to address hard forks and airdrops for cryptocurrency, and new FAQs.

The IRS requires 2019 Schedule 1 for adjustments to include cryptocurrency gains and losses.

The IRS adds a question on form 1040 asking about virtual currency

We keep up with the latest rules, regulations, and trends so you don’t have to! Sign up to get crypto accounting tips, tax strategy and advice, and crypto news from the expert in your inbox.

For assistance in planning and transferring your U.S. assets to Canada, please contact our colleague Phil Hogan, CPA, CA, CPA at (250) 661-9417 or phil@philhogan.com