Below you will find a list of recommended daily bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to post near your computer:

Daily Bookkeeping Checklist Download

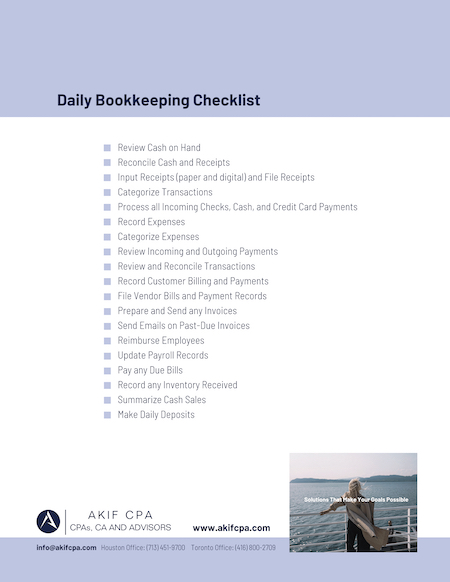

Daily Bookkeeping Checklist

- Review Cash on Hand (details)

- Reconcile Cash and Receipts (details)

- Input Receipts (paper and digital) and File Receipts (details)

- Categorize Transactions (details)

- Process all Incoming Checks, Cash, and Credit Card Payments (details)

- Record Expenses (details)

- Categorize Expenses (details)

- Review Incoming and Outgoing Payments (details)

- Review and Reconcile Transactions (details)

- Record Customer Billing and Payments (details)

- File Vendor Bills and Payment Records (details)

- Prepare and Send any Invoices (details)

- Send Emails on Past-Due Invoices (details)

- Reimburse Employees (details)

- Update Payroll Records (details)

- Pay any Due Bills (details)

- Record any Inventory Received (details)

- Summarize Cash Sales (details)

- Make Daily Deposits (details)

Of course, there may be additional tasks depending on your business, and some of these may not apply to you. This is a general guideline, so be sure to consult with your CPA or your in-house team to confirm what is necessary for you.

More checklists:

Detailed Breakdown of Daily Bookkeeping Tasks

Review Cash on Hand

Verifying cash on hand (the amount of cash the business can access) ensures that your books are in appropriate order and any inputs you make will be accurate, that you don’t overdraw accounts, and that you are prepared for any unexpected expenses.

Reconcile Cash and Receipts

Reconciling cash will help you identify any shortages, overages, or anomalies quickly. This will ensure you not only have enough to cover expenditures, but alert you quickly of any potential thefts or potential errors.

Input Receipts (paper and digital) and File Receipts

Inputting receipts both paper and digital is important for your record keeping process. Make sure you input them into your accounting software to maintain accurate records.

Categorize Transactions

Every single transaction your business makes must be classified and documented. Make sure you add all transactions to the appropriate category.

Process all Incoming Checks, Cash, and Credit Card Payments

Processing payments includes updating your ledger, associating payments with the appropriate accounts and/or customer, and updating your balance.

Record Expenses

Be sure to record any expenses your business makes.

Categorize Expenses

Make sure you assign all business expenses to the appropriate categories. These can include things like payroll, employee benefits, office supplies, utilities, rent payments, insurance, equipment, travel, etc.

Review Incoming and Outgoing Payments

Check for any scheduled incoming and outgoing payments to ensure there is enough balance to cover and that these dates match with your expectations.

Review and Reconcile Transactions

Review all transactions for accuracy, reconcile invoices with amounts paid, expense receipts with bank transactions, etc.

Record Customer Billing and Payments

If customers have paid, be sure to record payment and mark invoices as paid in your accounting software. Also make any note of any delays in payment or missing payments.

File Vendor Bills and Payment Records

If you have paid bills or vendors, log the expenses and file the appropriate bills and transaction receipts in accordance with your accounting software.

Prepare and Send any Invoices

Generate any invoices and send to the appropriate client.

Send Emails on Past-Due Invoices

Be sure to communicate if invoices remain unpaid and are past due (including late fees).

Reimburse Employees

Reimburse employees for any expenses (you may do this as part of payroll as well, but some businesses do so as the expenses are logged).

Update Payroll Records

Make sure any updates for your W2 employees, 1099 independent contractors, and other worker records are up to date with hours, payments, etc.

Pay any Due Bills

Pay any bills that are required.

Record any Inventory Received

If inventory is received, be sure to log the inventory and any associated expenses or surpluses in accordance with your company’s best practices.

Summarize Cash Sales

Cash sales are critical to any business, and accurate summaries make it easier to show their performance and impact over time.

Make Daily Deposits

Daily deposits ensure all money is accounted for, in the appropriate bank accounts, and prevents any confusion about financial status.