Understanding Foreign Tax Credit

Taxation terms, sometimes, appear very complex to understand. Moreover, the rules and regulations involved in the process make the situation more complex to understand.

Before we use any jargon for Foreign Tax Credit, let’s understand this concept by using a very basic example.

Imagine John is a citizen of the U.S. and he’s also a resident of Canada as well. John gets some Canadian income and is subjected to report his income for the taxation processes in both countries.

However, if John has already paid his tax to the Canadian government, he will be given some foreign tax credit by his home country (U.S.).

Using a foreign tax credit, he can avoid unnecessary double taxation since he has been taxed on this income before as well. However, before pursuing any foreign tax credit, you need to be aware of the different rules and regulations of FTC.

How much foreign tax credit you are eligible for?

The short and simple answer would be “it depends upon your financial data and taxes that you paid abroad”.

These can vary a lot from person to person. Moreover, these situations are hard to understand since it also depends upon the country you paid your taxes in. If you’re finding it hard to calculate your amount, consult our cross-border taxation expert today.

Important points to note for the U.S. expats to claim FTC

Following are some of the rules and regulations to be considered under the umbrella of foreign tax credit:

- You are bound to pay taxes in another country.

- The taxes should have already been paid in a foreign country you are residing in.

- You should have paid income tax in your foreign country.

- The paid foreign tax liability should be within the current tax year.

The IRS has written a detailed article explaining different eligibility rules for the foreign tax credit.

Calculate Your Foreign Tax Credit

Before we move on and start calculating your foreign tax credit, we need to discuss some of the potential metrics involved in the process.

Here are the five metrics first:

- Your taxable income in a foreign country.

- Taxes you paid in the resident country.

- The total taxable income you owe in both countries.

- The tax liability you have to pay in the U.S.

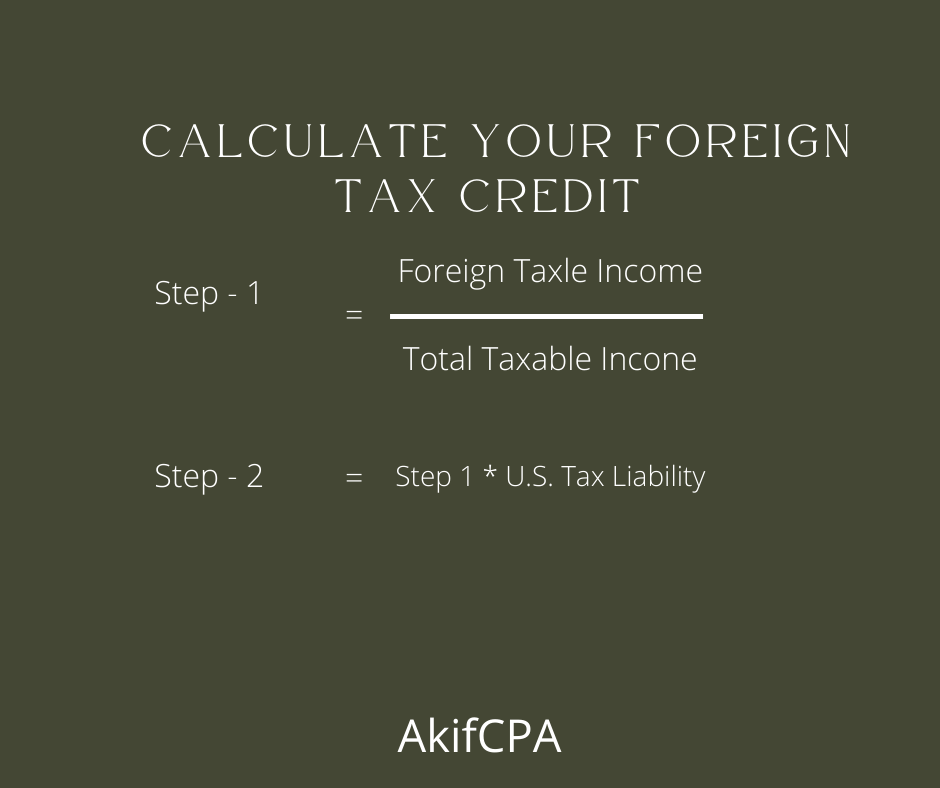

The formula to calculate your foreign tax credit is divided into these steps:

- Step 1 – Divide your taxable income in a foreign country (numerator) by the total taxable income you owe in both countries (denominator).

- Step 2 – Multiply the answer (in step-1) with the tax liability you have to pay in the U.S.

The amount you calculate after these steps would be your Foreign Tax Credit. The IRS has written extensive details about figuring out the foreign tax credit.

Moreover, if you want to calculate your carryover amount which can be used for up to 10 years, subtract the above answer (generated after completing step 2) from the taxes you paid in the resident country.

We totally understand that this may sound confusing. In the next step, we have used a practical example to help you understand the process easily.

Calculating foreign tax credit with an example

Imagine there’s a person John with U.S. citizenship and he is residing in Canada. He holds a job in a bank. John produces $100,000 in salary. He has paid $50,000 in taxes to the Canadian government.

Moreover, John’s yearly U.S. taxes are $20,000 and he also possesses a taxable $5000 U.S. income.

Following is the table to measure the maximum FTC John can get:

| Step 1 | Step 2 | Carryover Amount |

|---|---|---|

| Foreign Taxable Income / Total Taxable income in both countries | Multiply Step 1 with Tax Liability in the U.S. | Taxes Paid in the Resident Country – Step 2 |

| $100,000/$105,000 = 0.83 | 0.95*$20,000 = $19,048 | $50,000 – $19,048 = $30,952 |

Please note that the example used over here only serves the hypothetical scenario about how we calculate foreign tax credit.

Check your foreign tax credit without any calculations

If you’re new to these concepts, this may appear confusing to you. If you want to free yourself from the tiring process of checking how much foreign credit you have and how to go about its different processes, we are here to file for you.

We have spent years understanding the challenges of taxation. We make sure that you save your money with us. Contact us today, and we’ll take care of your burdens.