To keep your business in good books with the office of the Secretary of State, it is important to file accurate returns on time and keep up with payments. Moreover, it is also important that your tax strategy is designed to optimize savings and lower your tax burden as much as possible. Many business owners achieve this at a federal level, but forget to build a strategy around their state-level taxes.

Below is a guide to Texas Business Taxes.

There are three main types of business taxes in Texas:

The franchise tax is a state tax, imposed by Texas, not the federal government and IRS. In the coming section, we have listed some of the categories that are required to file Franchise Tax. Moreover, we have mentioned a method for calculating Franchise Tax.

Any entity that operates under the territory of Texas and lays its foundation in the Texas region is required to file Franchise Tax.

Following are some of the entities that are required to file Franchise Tax:

Moreover, it is also important to note that some of the entities, for example, sole proprietorships, are NOT required to file Franchise Tax. We’d recommend talking with a Houston CPA to know if you qualify to pay Franchise Tax.

You may need the following information to calculate Franchise Tax:

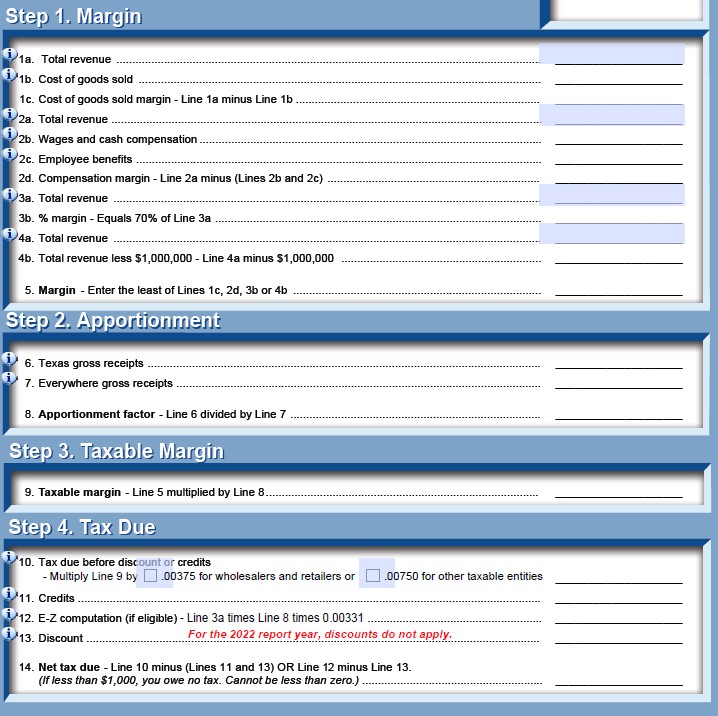

1. Margin

If you fall under the category of Franchise Tax, you will be taxed on the entity’s margin with ONE of the following criteria:

It is also important to note that you can “Apportion” the margin. This can be done by using a single-factor apportionment formula based on gross receipts.

2. Total Revenue

You can calculate the total revenue by subtracting statutory exclusions from the total revenue amount reported for the federal income tax.

Some of the exclusions are as follows:

3. Cost of all the Goods Sold

This cost refers to all the costs that are related to the production of any tangible property. Moreover, it is important to note that services will NOT have this cost.

4. Compensation

Compensation includes 12-month taxable wages (w-3) that you pay to your employees, partners, owners, and directors. Furthermore, this wage is subjected to inflation-adjust person wage and compensation limitations.

The compensation also includes benefits provided to all the personnel even if they are deductible for federal income tax purposes that include retirement benefits and health care benefits. In the Franchise Tax, the compensation does NOT include 1099 labor or payroll taxes.

Following are some of the steps mentioned by the Texas government to file and calculate franchise tax.

Texas is of nine states with no personal income tax. In short, Texas does NOT have state Personal Income Tax. However, to regulate the taxation processes, Texas depends upon other taxes like sales tax or property tax. However, if you are a business owner, you may need to file some of the tax forms that may imply on you. Except partnership which needs to file informational return, all business structures have to file Texas business tax annually.

Following are some of the forms that you may need to submit while filing Texas Tax:

If you need any assistance while filing these forms or if you have any questions, you can always consult with our Houston Accountant who has years of expertise understanding Houston Taxes obligations.

Texas sales tax is defined by the nexus. Furthermore, nexus is defined by the level of activity you business holds in the Texas. For example, if your business uses territory of the Texas then you will be categorized under the physical nexus.

There are two types of Nexus:

Moreover, it important to note that services are taxable as well. You can quickly talk with your Houston Accountant to inquire about different sales taxes you are obliged to pay.

If you live and sell inside the Texas, you only need to calculate your sales tax based on the Texas Sales Tax Rate – 6.25%. Furthermore, if you are a seller and have made a sale into Texas from another state, you will charge the sales tax based on the buyers’ address where the item got shipped.

In addition to taxable products and services, shipping charges are also taxable in Texas. This information may confuse you sometimes, and it is strongly NOT advisabe to file your taxes while being in confusion. You may get penalty as well if you file your taxes with inaccurate information. A quick consultation with the Houston Accountant can save your time and money.

The majority of Texas firms, except sole proprietorships as well as certain partnership firms, are subject to a franchise tax . Texas doesn’t have an individual income tax at the same time. Therefore, even though your Texas company itself may be liable to the franchise tax, any money left over after paying these taxes that goes to you personally won’t. The information below will surely help you with the long run dynamics about how corporations are taxed in Texas according to their own kinds.

Here are the Texas Corporation Taxes:

In coming section, we have listed some details about all the processes you may need to comply with if you fall under specific category.

All LLCs must pay franchise tax in Texas.

Standard LLCs are transit businesses in the majority of states, meaning they don’t have to pay state or federal income taxes. Rather, the company’s revenue is divided to specific LLC shareholders, who are then responsible for paying both state and federal taxes on the money received. Any share of the company’s net profits that a member eventually receives is not subject to state tax.

Additionally, the majority of states tax every single investor on the part of the corporation’s yearly net revenue they get rather than subjecting S corporation to a different taxable income.

S corporations are filtered organizations in the majority of states. S corporations are nonetheless liable to the government’s franchise tax even if Texas does recognize the federal S election. Regardless of the amount of the corporation’s net income that a shareholder finally receives, they are not required to pay state tax on it.

The franchise tax is applicable to the majority of partnerships in Texas. Limited partners individually incur no state income tax on partnership interest given to them.

An individual, a firm, or a limited liability corporation can all own and manage a sole proprietorship. The company doesn’t have any partners. As the sole owner, you will receive distributions from your company and be responsible for paying federal tax on such distributions. You won’t have to pay state taxes on the revenue from your firm, though, as Texas has no personal income tax other than on dividends and interest.

Setting the right tax strategy needs years of expertise. Imagine burning your cash flow while paying unnecessary taxes when you are just at the start of a new business. Moreover, filing your taxes with inaccurate information may also lead you to get penalties as well.

We’d highly recommend talking with a Houston Accountant while filing your business taxes. You can save your money with him. Moreover, you can dedicate your time to the place where you hold the expertise. Meanwhile, your accountant is looking into your business taxes.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

For assistance in planning and transferring your U.S. assets to Canada, please contact our colleague Phil Hogan, CPA, CA, CPA at (250) 661-9417 or [email protected]