Below we offer our best tips for choosing the right Houston accountant for your business.

Our team of Houston-based accountants are here and ready to help you with all of your accounting, bookkeeping, payroll, tax, and other financial needs. Please contact us today to set up a consultation.

Choosing a Houston accountant who meets your needs and goals can contribute to the financial success of your company. However, with so many options, you might be struggling with how to choose the right one.

Since you invest your resources in an exchange for their services, you must set some criteria and checks. We have gathered some points where you can check the credibility of an accountant, as well as verify their legitimacy and that they can meet your needs. These items will help you measure his expertise and how he can help you achieve your goals.

According to BrightLocal, almost 87% of consumers in the U.S. prefer to read online reviews while evaluating the profile of a local business.

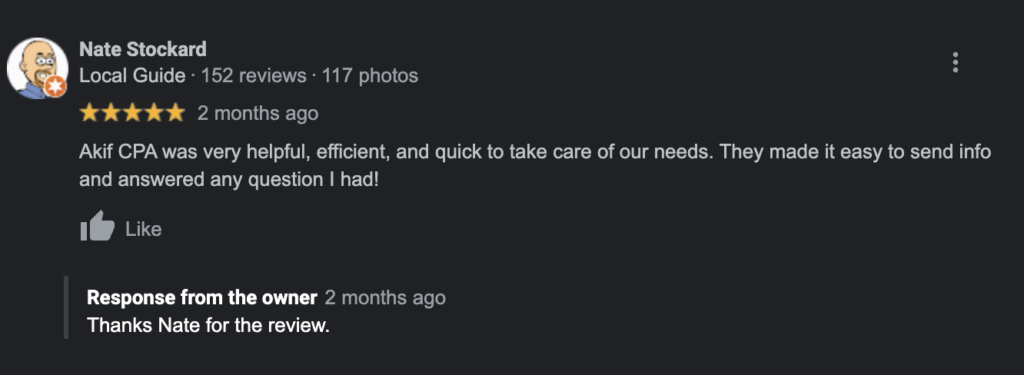

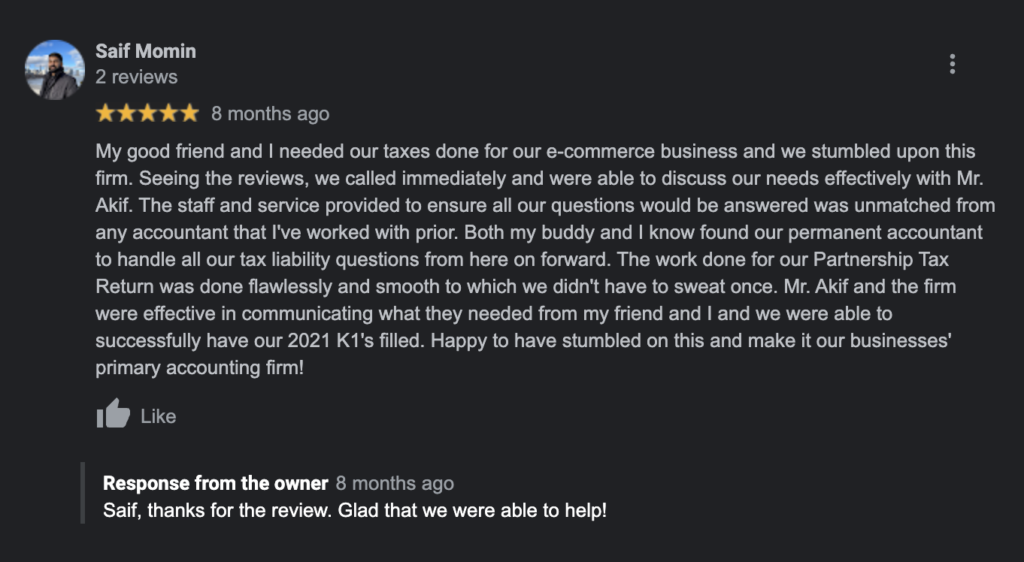

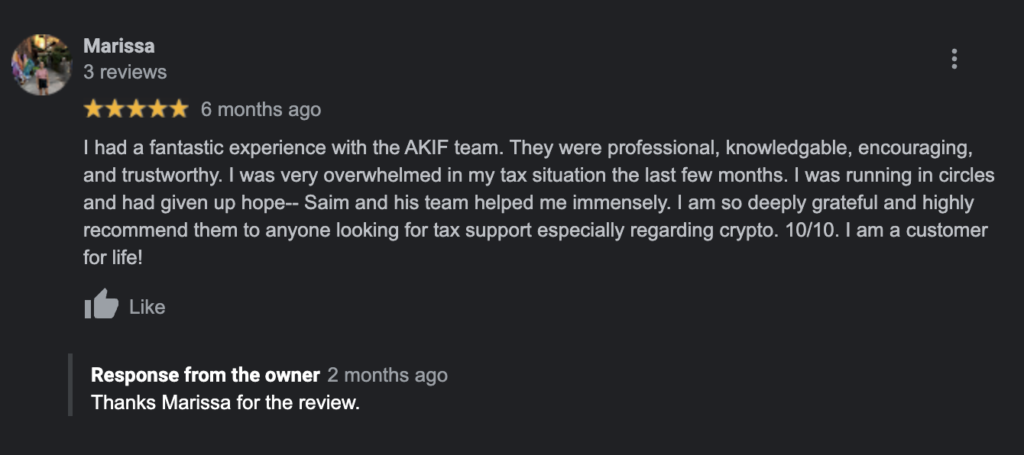

Google can be a valuable place to measure the credibility of your potential Houston accountants. You can quickly analyze how your accountant has managed past and current clients, see what people are saying about the firm, and look for specifics like communication style, customer service, or specific expertise.

You should note the general trend in the reviews. It is normal for any business to receive some negative reviews as well.

Moreover, it’s also important to differentiate between fake and real reviews. Typically, bot reviews are five stars, from multiple locations, offer no feedback and just the rating.

For real reviews, look for:

Here are some examples from our own Google Reviews:

You can get a great sense of how the CPA firm operates and where they excel based on this. Since the reviews show past clients, these tiny yellow stars have a big part to play when choosing the right Houston accountant.

Some accountants have expertise in a specific financial task, such as bookkeeping or tax preparation and others have broader expertise and can help you strategically plan many other aspects of your business. But, they can also specialize in an industry, like Real Estate and Construction, E-Commerce, or Digital Content Creators.

Specialization is important when it comes to selecting a CPA because it impacts everything from the services they provide to the expertise they can offer.

Service expertise means working with a CPA who is offering services that match your needs. If you need ongoing budgeting and financial forecasting, it’s important to work with a CPA who has the tools, platforms, and expertise to offer this.

Industry expertise means experience in your area. For example, if you have started exploring crypto as an investment or a business, it’s important to note that not every CPA understands how crypto works or is following the changing IRS regulations. Asking a potential CPA if they have other clients who offer the services you are looking for is a great way to understand what they will be able to provide for you.

Experience is certainly an area of specialty. You may wish to work with a well-established firm with decades in business, or may consider working with someone newer who is looking to build up their initial client roster.

Understand what is important to you from a specialty standpoint and vet any potential CPAs accordingly.

It is possible that you are not always present around the physical proximity of your accountant. It is, of course, ideal to have a physical office you can visit, but also the ability to speak virtually, submit documents, and even pay from wherever you are in Houston or around the world.

A virtual consultation or meeting can help you in many ways. Since you are busy with your routine, and you are dedicating your time to your priorities, it is far more convenient to consult with your accountant on a virtual consultation than to visit the office every single time you have an issue or question. Screen sharing also makes this a richer remote experience, because your CPA can present any financial reports to your whole team or walk through documents together.

Moreover, if you’re working with a CPA on accounting and he or she will be directly looking into the financials of your company, you need his or her availability without being restricted by geographical boundaries.

If you are considering multiple CPA across Houston, virtual consultations can give you a better idea of the CPA’s values and dynamic without having to drive all over the city. In this regard, it can save extra time and energy from the first meeting throughout!

Accounting software is specifically designed to help accountants automate routine tasks. These software help accountants manage numerous transactions, regulate compliance, and issue payroll.

An experienced accountant uses Regulatory Compliance Verification software to determine whether the company’s financial records are in compliance with the law. This can be software like ADP or Quickbooks, depending on what services the CPA is providing you and what the needs are.

You can ask your accountant about the software he uses to maintain all the financial records and if there is an online portal through which you can submit documents.

Furthermore, you may ask some counter questions about different regulations and how these software are helping them to maintain compliance with the regulations.

An experienced accountant will reflect confidence in his answers and will be well-versed with the regulatory laws that software is helping to maintain.

Businesses are vulnerable to changes in monthly cash flows. To make better operational decisions, improve financial visibility, and seize new opportunities, your accountant should provide monthly reports.

It helps a business owner to maintain accountability as well. You need to ask your accountant about which metrics they present in monthly reports and which reports they provide.

Below are some of the reports that your accountant should provide:

Read More: The 4 Types of Accounting Statements

These reports vary depending on the problem your accountant is working on, however, reports always provide valuable feedback on the financial health of your company.

To ensure the credibility of a Houston accountant, you can check if he has all the certifications mentioned by the IRS.

Following are some of the certifications that you may need to measure their credibility if you need a Houston to deal with your taxes:

You can verify the CPA license with the TSBPA. Many CPAs will also post badges of certifications and professional societies they are members of on their firm or individual websites.

If you are looking for a CPA specifically, verifying their license is critical. Other certifications and memberships, like badges for completing International Tax Core Concepts with AICPA or being a member of the Texas Real Estate Commission (for CPAs working with construction and real estate firms).

Once again, these certifications depend upon the problems and consultations you need.

With virtual CPA services on the rise, there are firms operating in Houston without Houston offices, and that’s something to be aware of when making your selection. Your CPA should be licensed in your state, involved in local professional organizations, and be operating out of Houston.

However, because Houston is a major economic center in the U.S., it is not uncommon for local firms (even small businesses and family owned!) to have offices in other cities.

In short, it’s more efficient and cost-effective to hire an accountant who has experience dealing with Houston clients previously than one who does not.

Blogs can be a useful method to measure the credibility of a Houston accountant. It shows that your accountant is up-to-date on the new regulations and properly invests his energy to understand these laws.

Moreover, it gives you the chance as well to understand how knowledgeable your accountant is. For example, at Akif CPA, we have a dedicated Houston page and we have mentioned all the relevant blogs and information you may need to know.

Following are some of resources we published:

We regularly update our clients with the updated information and share valuable insights to grow your business in Houston.

To consult with our Houston CPA, you can contact us today. We have provided valuable consultation to hundreds of Houston clients, and got 100+ five star reviews on Google. We definitely look forward to help you growing your business.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

For assistance in planning and transferring your U.S. assets to Canada, please contact our colleague Phil Hogan, CPA, CA, CPA at (250) 661-9417 or phil@philhogan.com