Below you will find a list of recommended monthly bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to post near your computer:

Monthly Bookkeeping Checklist Download

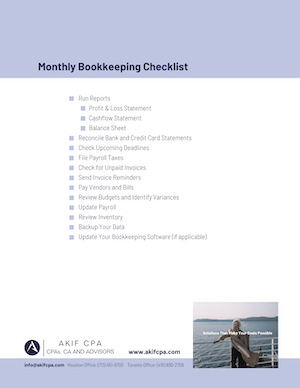

Monthly Bookkeeping Checklist

- Run Reports (details)

- Profit & Loss Statement

- Cashflow Statement

- Balance Sheet

- Reconcile Bank and Credit Card Statements (details)

- Check Upcoming Deadlines (details)

- File Payroll Taxes (details)

- Check for Unpaid Invoices (details)

- Send Invoice Reminders (details)

- Pay Vendors and Bills (details)

- Review Budgets and Identify Variances (details)

- Update Payroll (details)

- Review Inventory (details)

- Backup Your Data (details)

- Update Your Bookkeeping Software (details)

Of course, there may be additional tasks depending on your business, and some of these may not apply to you. This is a general guideline, so be sure to consult with your CPA or your in-house team to confirm what is necessary for you.

More checklists:

Detailed Monthly Bookkeeping Tasks

Run Reports

Run monthly financial reports to get an overall view of the state of business and performance. This can include a P&L Statement, Cashflow Statement, Balance Sheet, or other reports.

Reconcile Bank and Credit Card Statements

With your monthly bank and credit card statements in, be sure to reconcile all transactions and receipts to ensure your ledger is up to date and accurate, you weren’t double charged for everything, and that ever dollar in and out is accounted for.

Check Upcoming Deadlines

Review upcoming tax, reporting, and registration deadlines to ensure your business is in good standing and are filing necessary forms and paying taxes on time.

File Payroll Taxes

If you are withholding and paying taxes regularly, make sure you file the appropriate forms and issue payments each month.

Check for Unpaid Invoices

On both sides of accounts payable and accounts receivable, check and review invoices due for the month and ensure they are paid, while also checking status on any other invoices upcoming.

Send Invoice Reminders

Send invoice reminders with payment deadlines to any clients who have not yet paid (or may be overdue).

Pay Vendors and Bills

Pay and schedule all monthly bills and any vendor payments that are due for the month.

Review Budgets and Identify Variances

Take a look at your budget and your monthly reports and identify any variances or anomalies in the report.

Update Payroll

If you issue payroll monthly, make sure it is scheduled. Be sure to also update any changes to payroll, log employee hours, and withhold and report appropriate taxes.

Review Inventory

Check inventory and ensure it matches the amounts in your inventory report. This helps to determine how much inventory must be ordered, what is selling, and can be instrumental in identifying seasonal trends in your business. It’s also helpful to identify potential theft or missing items.

Backup Your Data

The IRS requires you to maintain records, so it’s important to have accurate backups done regularly of your financial data, client data, and any other company-sensitive information.

Update Your Bookkeeping Software (if applicable)

If you are not using a cloud-based system with automatic updates, make sure you update your bookkeeping software. This will decrease potential for errors, crashing, and other software problems.