Why do small businesses outsource their accounting services? It’s simple. Accounting is a time-intensive, risk- and error-prone element of running a business that impacts everything from inventory to profit and your bottom line.

Outsourcing No Longer Means Sending Work Overseas

While many businesses have historically outsourced their work overseas, you may be reticent to do so with something as critical as accounting. If you have this worry, just know that you are not alone!

It’s a common misconception that your only option is to hire someone overseas, and simply trust they understand the financial mechanisms, regulations, and laws within the U.S. But, the truth is that most small business owners who outsource their accounting services do so to U.S.-based accounting firms with Certified Public Accountants (CPAs).

Understand the Pros and Cons

While outsourcing might seem like a no-brainer, it’s important to fully understand the pros and cons.

Pros:

- More Cost-Effective

- Lower Your Risk

- Virtual Services Mean Less Time-Consuming

- More Time to Focus on Your Business

- Get the Experience of an Expert for Less than the Cost of an In-House Accountant

Cons:

- Price Creep (depending on the range of your needs)

- Requires Trust

- You Have to Be By-the-Book

- You May Need to Attend to Ongoing Meetings

- Your Process Will Need to Change

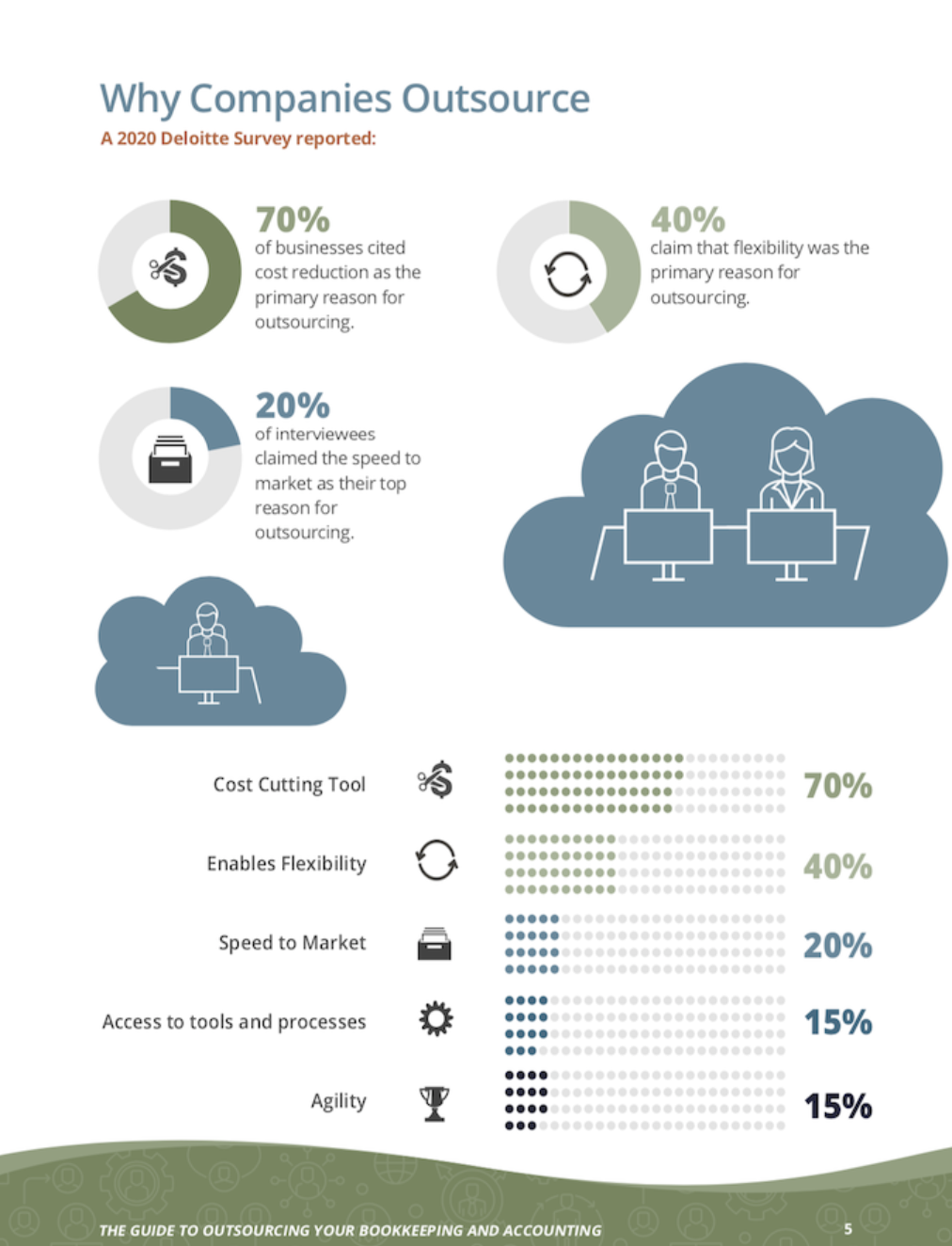

Image courtesy of Growth Force

While adjusting to the requirements and working style of an accountant can take some time, it’s important to remember that the more by-the-book you go, the lower your chance of risk.

What Accounting Services Can I Outsource?

Now that we’ve walked through the basics of outsourcing, let’s talk about what accounting services can be outsourced. The truth is, whether you need help with a single service like payroll or something broader like CFO services, the right CPA for your is out there and ready to help.

Here are a few services you can outsource:

Bookkeeping

Nearly every aspect of small business bookkeeping can be outsourced, including expense reporting, managing accounts payable and accounts receivable, bill payment, bank and account reconciliation, updating charts of accounts, and more.

Bookkeeping is a broad element of accounting, so it’s important to understand which services you plan to outsource, and which you plan to continue managing yourself (if any).

Payroll

Payroll can seem straightforward, but ensuring your employees and contractors are paid on time and in accordance with their contracts and labor laws is critical and an important part of risk management.

You can outsource not only the work, but the risk, and rely on a CPA to manage tax reporting, withholding, and expense reports.

Financial Reports

Whether you need monthly, quarterly, or yearly reports, or all of the above, most outsourced CPAs will offer financial reports so you can get a 360° view of the financial state of your business. If you are seeking a business loan, investors, or prepping for an acquisition, your CPA can also provide the necessary financials.

Controller Services

While many businesses don’t consider the importance of a controller, outsourcing this service to a third party is a great way to ensure you have a trusted team monitoring cashflow. This reduces risk of employee theft, ensures you remain compliant, and means you’ll have an ongoing, thorough analysis of your cashflow, with any red flags brought to your attention straight away.

CFO Services

Many small business owners don’t have the budget or requirement for a full-time CFO. This is where outsourced CFO services—a growing and popular service—come in. You’ll get all the benefits of a full-time CFO without the full-time price tag. A CFO typically manages all financial reporting, monitoring company assets and cashflow, and directs the business with financial goals in mind.

Budgeting and Forecasting

Building a budget is tough for anyone, but small businesses working with typically tighter budgets and margins especially benefit from help with budgeting. When you outsource this, you also get a CPA who can build a reasonable budget that supports your goals, and learn how this will impact your growth and the measurable success of your business.

Planning and Analysis

Most small business owners are not financial experts, which is why planning and analysis can be an incredibly impactful service to outsource. The right CPA will have expertise from helping hundreds of businesses plan for their future and better their financial strategies, all of which you will benefit from.

Ready to Outsource Your Accounting?

If you’re ready to hire a CPA to manage your accounting, be sure to prepare a list of services you’re ready to offload, and start setting up consultations. Make sure that the CPA you are speaking with has a proven history of working with other small business owners (check for reviews that offer specifics) and, ideally, has industry experience.

Our Accounting and Bookkeeping Services include everything from payroll and ledger upkeep to bookkeeping cleanups, forecasting, and more. Let our team of trusted CPAs and advisors be your partner in business success!