Small businesses often face numerous challenges when it comes to managing their finances. They have to ensure that their accounting records are accurate and up-to-date, comply with tax regulations, and make financial decisions that can impact their business’s growth. Outsourcing accounting services can help small businesses overcome these challenges and provide them with several benefits.

Key Benefits of Outsourcing Accounting Services

Outsourcing accounting services refers to the process of hiring an external accounting firm to handle a company’s accounting needs. This firm may offer a range of accounting services such as bookkeeping, tax preparation, financial reporting, payroll management, and more. Here are some reasons why small businesses should consider outsourcing their accounting services:

Cost-effective

Outsourcing accounting services can be a cost-effective option for small businesses. It eliminates the need to hire a full-time accountant or finance team, which can be expensive, especially for small businesses that are just starting. Outsourcing accounting services allows small businesses to pay for only the services they need and when they need them. It can help reduce operating costs and improve the company’s financial performance.

Access to expert knowledge

Accounting firms that offer outsourcing services often have a team of experienced accountants who specialize in various areas of accounting. These professionals have the knowledge and expertise to help small businesses navigate complex tax regulations, financial reporting, and accounting software. They can also provide valuable advice and insights that can help small businesses make informed financial decisions.

Focus on core business activities

Outsourcing accounting services allows small businesses to focus on their core business activities without worrying about managing their finances. It gives business owners more time to focus on marketing, sales, and customer service, which can help improve the company’s bottom line. By outsourcing accounting services, small businesses can free up their resources and focus on growing their business.

Scalability

Outsourcing accounting services provides small businesses with flexibility and scalability. As the business grows, the accounting needs of the business also grow. Outsourcing accounting services allows small businesses to scale their accounting needs as their business grows. The accounting firm can provide additional services, such as financial planning and analysis, as the business expands, without the need to hire additional staff.

Reduced Risk of Errors

Accounting errors can be costly and can have a significant impact on a small business’s finances. Outsourcing accounting services to a professional accounting firm reduces the risk of errors. Accounting firms have processes and procedures in place to ensure that their clients’ accounting records are accurate and up-to-date. They also have the expertise to identify potential errors before they become costly mistakes.

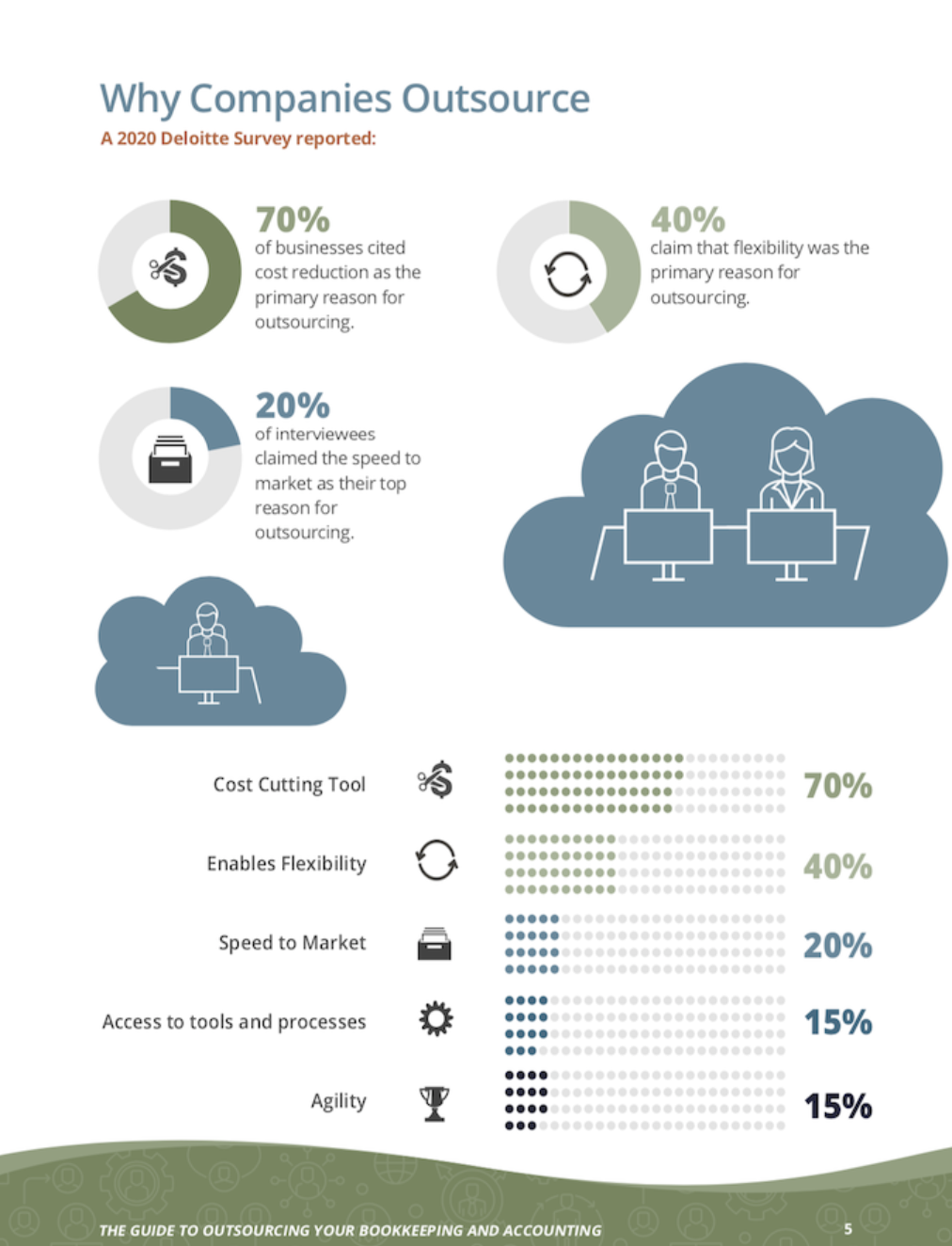

Image courtesy of Growth Force

Understanding the Pros and Cons

Outsourcing accounting services can provide several benefits to businesses, but it also has its disadvantages. Here are some of the pros and cons of outsourced accounting:

Pros:

- Cost savings: Outsourcing accounting services can help businesses save on operating costs, including salaries and benefits for in-house accountants.

- Access to expert knowledge: Outsourcing accounting services can provide businesses with access to specialized accounting expertise that they may not have in-house.

- Focus on core business activities: Outsourcing accounting services can allow businesses to focus on their core activities and avoid distractions related to accounting and bookkeeping.

- Scalability: Outsourcing accounting services can help businesses scale their accounting needs as they grow without the need for additional hiring.

- Reduced risk of errors: Outsourcing accounting services to professionals reduces the risk of errors in financial reporting and compliance.

Cons:

- Security concerns: Outsourcing accounting services may pose a security risk, as sensitive financial information is shared with a third-party provider.

- Communication challenges: Communication challenges may arise between the business and the outsourced provider, especially if they operate in different time zones or have language barriers.

- Lack of control: Outsourcing accounting services means the business has less control over their accounting processes, which could lead to issues with quality control and compliance.

- Dependency: Outsourcing accounting services could make the business dependent on the provider and make it difficult to switch providers or bring accounting back in-house.

- Cultural differences: Outsourcing accounting services to a provider in a different country may lead to cultural differences that could impact communication and understanding of business practices.

Outsourcing accounting services has both advantages and disadvantages. Businesses should carefully consider their options and ensure they choose a reputable provider that aligns with their needs and business objectives. They should also take appropriate steps to mitigate any potential risks and ensure they maintain control over their accounting processes.

What Accounting Services Can I Outsource?

Small businesses can outsource a range of accounting services depending on their specific needs. Here are some of the most common accounting services that can be outsourced:

Bookkeeping

This involves the recording and categorizing of financial transactions such as sales, expenses, and payments. Bookkeeping services can include accounts payable and accounts receivable management, bank and credit card reconciliations, and general ledger maintenance.

Payroll

Payroll management involves processing employee salaries and benefits, calculating taxes, and ensuring compliance with labor laws. Outsourcing payroll services can help small businesses ensure accurate and timely payment of their employees while reducing administrative burden.

Tax Preparation

Tax preparation services involve preparing and filing tax returns for businesses. This includes calculating and paying taxes, keeping track of tax deadlines, and ensuring compliance with tax regulations.

Financial Reporting

Financial reporting involves the preparation of financial statements such as balance sheets, income statements, and cash flow statements. Outsourcing financial reporting services can help small businesses gain insights into their financial performance and make informed decisions.

Accounts Receivable and Collections

Managing accounts receivable involves tracking customer invoices, following up on late payments, and managing collections. Outsourcing this service can help small businesses maintain positive cash flow and reduce the risk of bad debts.

Budgeting and Forecasting

Budgeting and forecasting services involve creating financial plans for businesses, predicting revenue and expenses, and analyzing financial trends. Outsourcing these services can help small businesses plan and manage their finances effectively.

Financial Analysis

Financial analysis services involve analyzing financial data to identify trends and patterns, and to provide insights into the business’s financial health. Outsourcing financial analysis services can help small businesses make informed financial decisions and improve their overall financial performance.

In summary, outsourcing accounting services can provide small businesses with a range of benefits, including access to expert knowledge, cost savings, scalability, and reduced risk of errors. Small businesses can outsource various accounting services depending on their specific needs, and partnering with a reputable accounting firm can help them manage their finances more efficiently and effectively.

Ready to Outsource Your Accounting?

If you’re ready to hire a CPA to manage your accounting, be sure to prepare a list of services you’re ready to offload, and start setting up consultations. Make sure that the CPA you are speaking with has a proven history of working with other small business owners (check for reviews that offer specifics) and, ideally, has industry experience.

Our Accounting and Bookkeeping Services include everything from payroll and ledger upkeep to bookkeeping cleanups, forecasting, and more. Let our team of trusted CPAs and advisors be your partner in business success!

*