Roughly 1,000 people turn to the internet each month to search for a crypto tax calculator. And, while there’s no way to know exactly what those searchers are hoping to calculate, we’re going to dissect the results and see which one you should use.

Looking at The 5 Most Commonly Used Crypto Tax Calculators

Instead of ranking the calculators by quality, we examined these calculators based on their positions in current search results on Google. Meaning, we looked at the Top 5 search results for “crypto tax calculator” to see what most people are finding and using, and examined the accuracy of that data.

We did our best to keep the data consistent:

- Single Filer

- $50,000 Estimated Taxable Income

- Cost of Crypto Purchase: $1,000

- Total Proceeds from Sale: $10,100

- Owning this Crypto for Less Than One Year

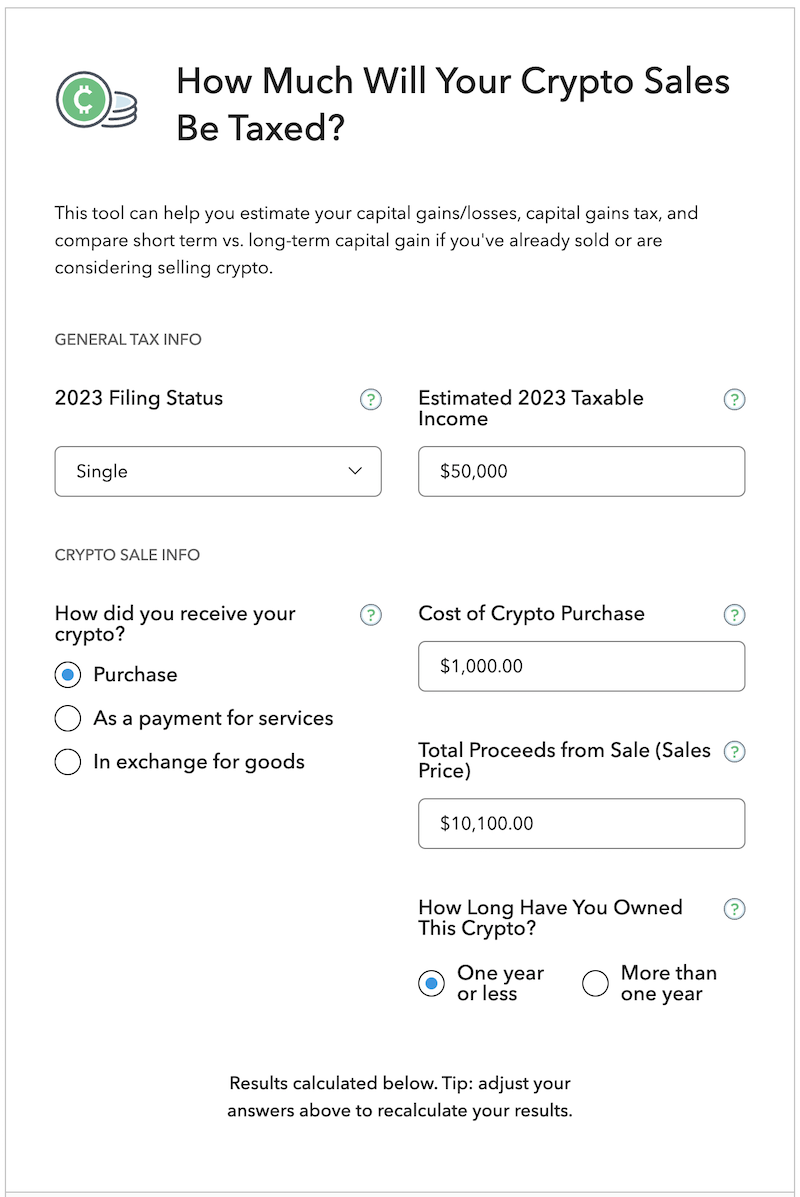

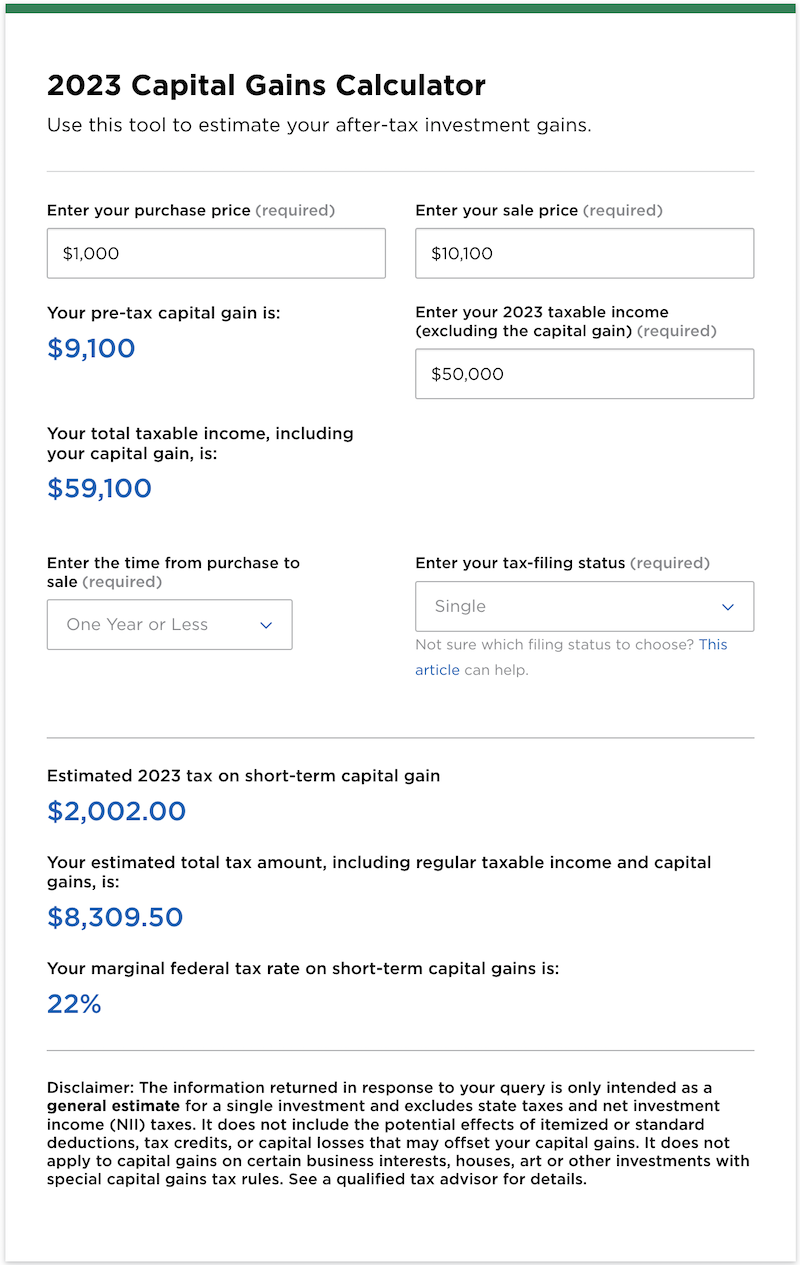

1st Result – Turbo Tax Blog Crypto Tax Calculator

Turbo Tax, owned by Intuit which also owns Quickbooks, was going to catch up to the crypto trend eventually. We’re not surprised to see a crypto tax calculator, nor are we surprised to see it as the #1 search result (they do have a marketing team of over 30 strong and an ad spend of over $100 million). Let’s take a look.

Image courtesy of blog.turbotax.intuit.com

The article this calculator is embedded within was published December 19, 2023, and updated most recently (as of this posting) January 10, 2024. There is a disclaimer that notes the calculator is meant for estimation purposes only, and only allows you to estimate one sales transaction at a time, and it excludes sales tax.

It’s also clear this is meant to funnel calculator users into using TurboTax Investor Center, the “new, premier cryptocurrency* investment tax software solution that offers crypto tax and portfolio insights” (* to a disclaimer about it not being a tax prep service or advisor and something about missing transaction info and variants based on your situation…) and the TurboTax Premium software.

Our Take: Use with caution, and verify with a crypto CPA. Here’s why:

There are some real limitations with this calculator. For one, it’s only based on a single transaction, which isn’t practical for nearly every client we have, there’s no ability to calculate how losses factor in, and it doesn’t account for state taxes. It is nice that it offers a tip for how to (potentially) lower your tax rate. For us, the biggest question mark is… what data and/or tax year is this based on? Is it being updated? Without that transparency, we can’t recommend relying on this calculator.

Aaaand… if we had a BTC for every client who came to us after using TurboTax only to realize they’d been overpaying taxes by thousands for years, well… you know how the saying goes.

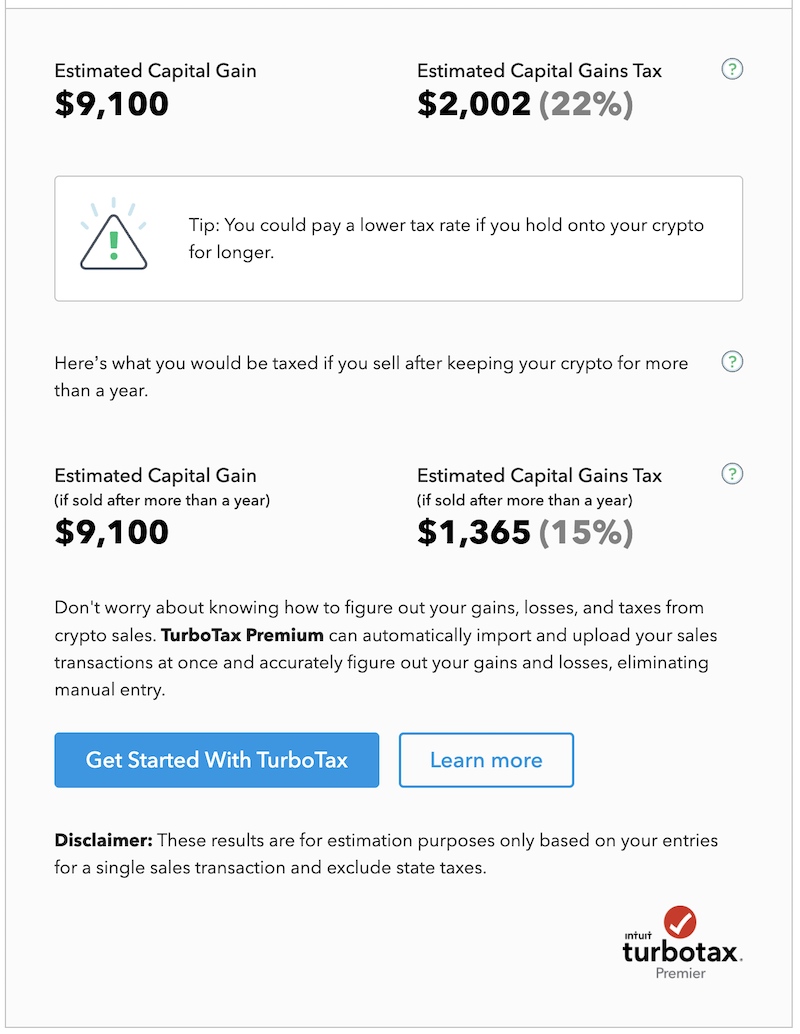

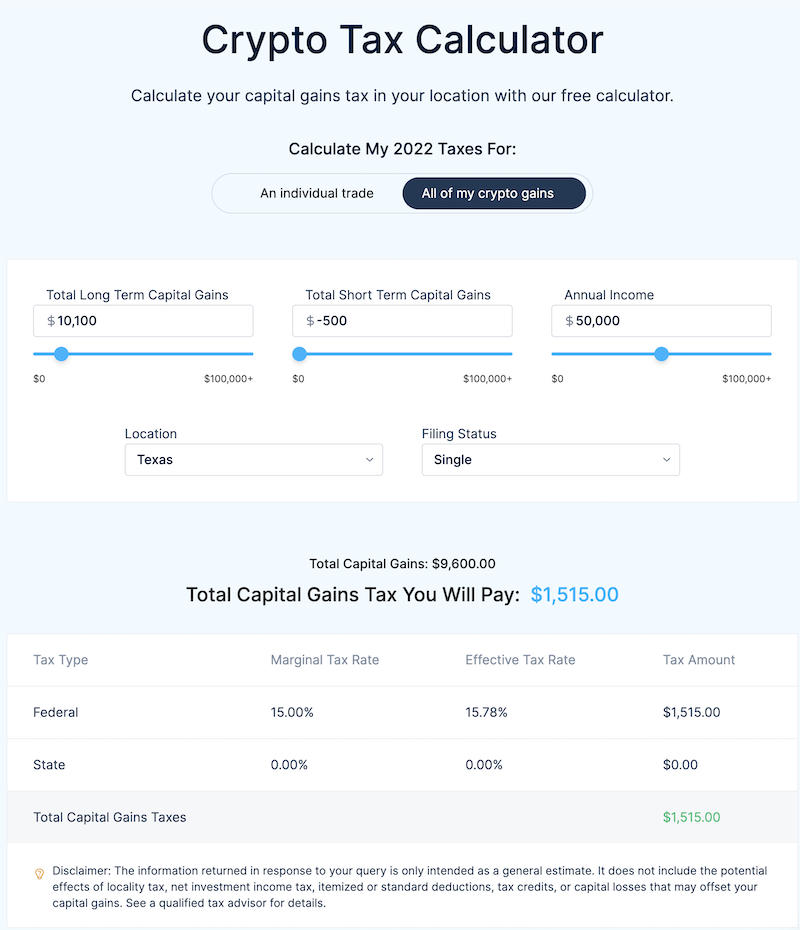

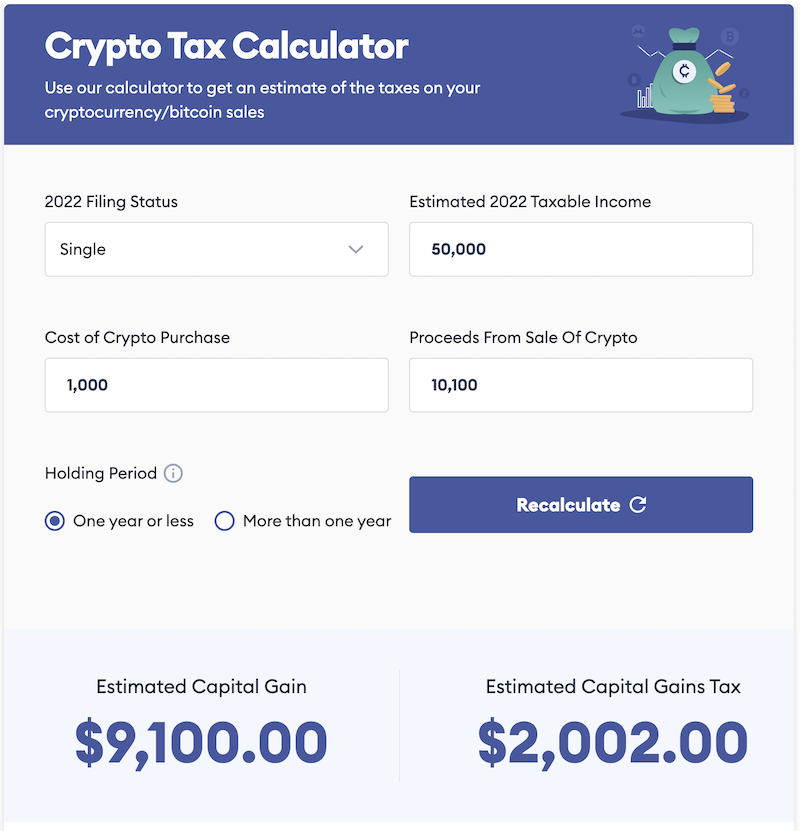

2nd Result – CoinLedger Crypto Tax Calculator

Leave it to CoinLedger to have the most robust calculator of the Top 5, with the option to calculate for an individual trade, AND an option to calculate for all of your crypto gains. Let’s take a look.

Images courtesy of coinledger.io

There’s much to like about this calculator. It makes up for where others on the list lack—sales tax, single trades vs. all crypto gains, inputs for fees, it can handle crypto losses. This calculator was also built by a company that focuses ONLY on cryptocurrency. CoinLedger is a crypto-specific accounting software that many of our clients use. This calculator is probably the most transparent in that it does also state that the results are a rough estimate. It does prompt you to “Calculate My 2022 Taxes”. But, it’s no longer 2022.

Our Take: It makes for a rough estimate for 2022 crypto taxes, which should be verified with a CPA. For 2023 and beyond, hard to say.

3rd Result – Nerd Wallet Cryptocurrency Tax Calculator 2023-2024

NerdWallet covers everything from crypto tax rules, tax rates, and tax software to basically all the same things they do for credit cards, banking, loans, investing, and everything in the finance field. They’re know for being a go-to blog for this sort of stuff, so no surprise to see them high up in the search results.

Image courtesy of nerdwallet.com

Let’s first take a collective note that the numbers we get from this calculator are different from the previous two. To recap:

| Calculator | Estimated Capital Gain | Estimated Capital Gains Tax |

| Turbo Tax | $9,100 | $2,002 |

| CoinLedger | $9,100 | $2,002 |

| NerdWallet | $9,100 | $8,309.50 |

What’s most interesting about this is that both TurboTax and NerdWallet’s calculator prompt you to calculate for 2023, but deliver different numbers.

Which, brings us to another important note. The NerdWallet calculator itself doesn’t actually say anything about cryptocurrency. It’s a capital gains calculator embedded into an article about cryptocurrency. Which, to be fair, is all any of these calculators are promising. That’s not inherently bad, but when our clients ask us to calculate their cryptocurrency tax, they’re not typically just looking for the capital gains, especially if they are hobby miners, treat crypto as a business, and are interested in being strategic about gifting and other crypto tax breaks.

Our Take: Overall, crypto is cutting edge and we always recommend working with data, calculations, and information that is specific to the idiosyncrasies of crypto. That this calculator delivered a different number than the others makes us reticent to offer anything other than caution not just for this calculator, but also for the entire list.

4th Result – Forbes Advisor Cryptocurrency Tax Calculator

Forbes Advisor has been covering crypto for a while now, so we’re not surprised to see they’ve also put out a calculator.

Image courtesy of forbes.com

While the article with this calculator says it was updated in January 2023, that’s still well over a year ago. It also appears that the calculator itself was probably supplied by Intuit (which owns both Quickbooks and TurboTax) in exchange for commission partner links. So…..

One extremely important note. If you check the disclaimer, you’ll notice this calculator is based on January 2021 tax laws. See below.

“Calculations are estimates based on the tax law as of January 2021. These rates are subject to change. Check the IRS website for the latest information about virtual currency gains.“

Our Take: We don’t recommend this calculator. The data is based on tax laws from over two years ago (and counting).

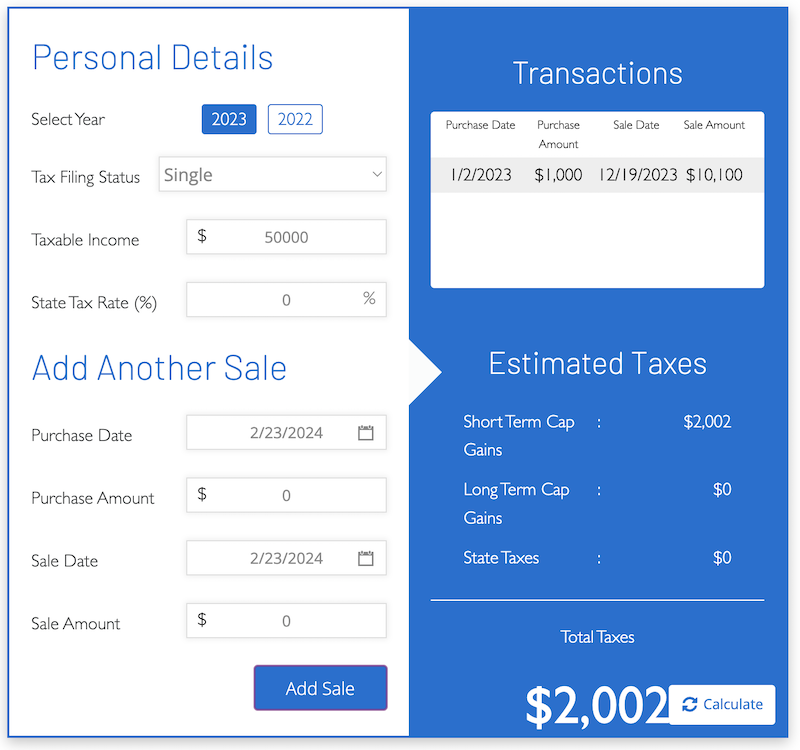

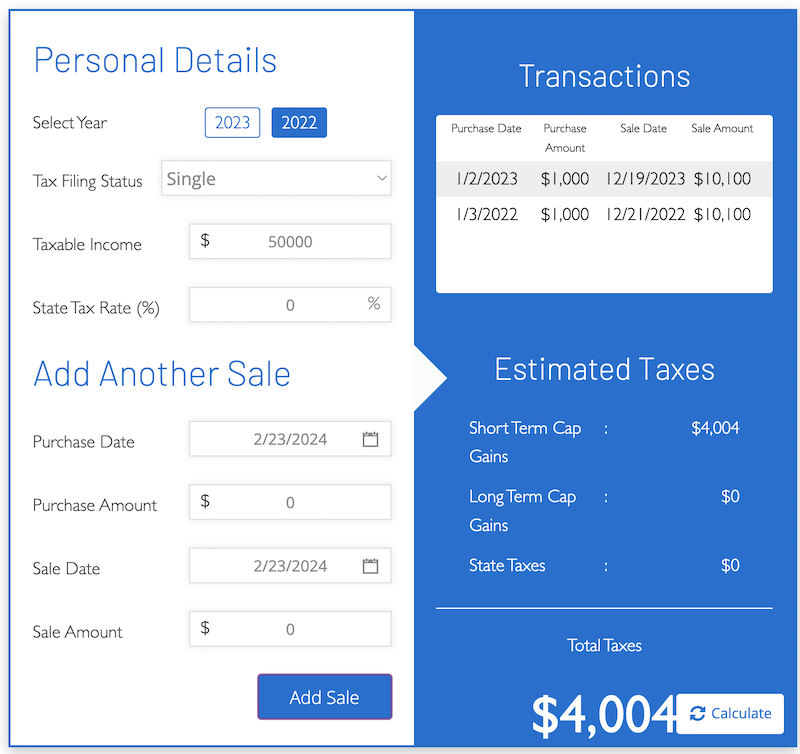

5th Result – TaxAct Bitcoin Tax Calculator

TaxAct is an online filing platform for federal taxes. Their blog covers topics like business finance, retirement, and tax planning. Their calculator takes a different approach. Let’s have a look.

Images courtesy of blog.taxact.com

This calculator has some nice features the others lack. For one, you can add multiple transactions and add purchase and sale date (it’s a small gripe, but their date selector is really annoying to use), along with your state tax rate (if you want to ready through your state’s tax laws or Google it and hope the date you received was correct). It also offers numbers for 2023 and 2022, and came out with the same number as 3 out of 4 of the previous calculators. This calculator also has examples to help you understand what you’re calculating.

However, there’s no date on the article, and no transparency as to what data it is based off of, though it’s probable to say it’s probably using the same as TurboTax and Forbes Advisor.

Our Take: Use with caution, and verify with a crypto CPA.

Our Overall Take and Recommendation

The most important thing we want to note in this article is that each of these calculators focus solely on capital gains. While the CoinLedger calculator does offer inputs for investment fee and exit fee, none of these calculators offer a full examination of your crypto tax ecosystem. Yes, crypto is taxed like stocks and property, and capital gains are a component of it.

Our take, at this point, probably won’t be surprising. Please don’t rely on a calculator you found on the internet to calculate your crypto taxes. The risks for error are too high.

We recommend you work with a CPA who specializes in cryptocurrency, meaning they are up to date on IRS regulations (ones that have passed and proposed legislation that is coming), can advise you on crypto tax strategy to optimize capital retention and cost savings, and who understands the complexity of cryptocurrency and what constitutes a taxable event. Additionally, if you’re relying on one of these calculators, you’re probably missing opportunities for setting up a business and potential deductions.

If you are in need of a cryptocurrency CPA, connect with our crypto accounting team.