In this article, we outline what a 1099-k is, how selling through online marketplaces and exchanging money through payment platforms impacts your taxes, and common misconceptions about 1099-k’s.

If you run an e-commerce business, please stop reading and contact our E-Commerce Team to get help with 1099-k’s, reporting, and tax and accounting, as your tax situation is much more complicated.

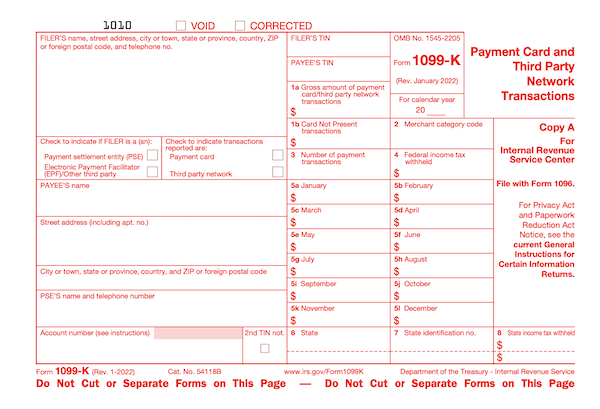

What is a 1099-k?

The 1099-K is a form that reports payments you received for goods or services over a specified threshold, usually from one of the following:

- Payment apps like PayPal, Venmo, Zelle, and Cash App

- Online Marketplaces like Ebay, Poshmark, Etsy

- Credit, Debit, or Gift Cards

So, if you sold a significant amount of goods through a third-party website, take payments through Venmo and Zelle, etc., or take payments via. credit or a banking card, you will likely receive a 1099-k. Any payment you received, whether it’s cash, property, goods, digital assets, foreign sources, or assets, must be reported as income.

What qualifies as a payment?

Any payment you’ve received for…

- Goods you’ve sold, including clothing, furniture, accessories, and equipment

- Services provided

- Rent for an income or rental property

With payments received through:

- A payment app (like Venmo, Zelle, and Paypal)

- An online community marketplace (like Facebook Marketplace or Poshmark)

- A craft marketplace (like Etsy)

- An auction site (like Ebay)

- Uber, Lyft, and other car share platforms

- Ticket exchanges (like Stubhub)

- Crowdfunding platforms (like Kickstarter)

- Freelance Marketplaces (like Fivrr, Freelancer, and Upwork)

You should have received your 1099-k by January 31st. Remember, you may receive multiple 1099-k’s, depending on your circumstances.

1099-k Thresholds for 2023, 2024, and Beyond

Before we dig into the thresholds, please note that even if you did not receive a 1099-k or did not pass the threshold, you still have to report these payments as income.

While the new $600 reporting thresholds for 1099-k was intended to kick in for 2023, the IRS announced a delay and a plan to treat 2023 as a transition year. As a result, at the time of this posting only taxpayers who received over $20,000 or completed over 200 transactions in 2023 should expect to receive a 1099-k. (As always, make sure you double check with your CPA to ensure you are following the most up to date requirements). Even so, you may still receive a 1099-k if you are over the $600 threshold.

The IRS is Currently Considering Setting the Threshold at $5,000 for 2024

While it has not been finalized, the IRS is currently considering (and encouraging taxpayers to plan for) a $5,000 threshold for the 2024 tax year.

Do I Still Have to Report My Income if I Didn’t Receive a 1099-k?

Yes. You must report all income from these types of sales. This is true for people who do and do not receive a 1099-k. One important note:

If You Sold Items At A Loss

If you sold a personal item at a loss, meaning you sold it for less than you purchased it for, there is no tax liability and you’ll be able to zero out that payment.

If You Sold Items at a Gain

If you sold a personal item at a gain, meaning you sold an item for more than what you originally paid for it, you must report that gain as income, and pay the necessary taxes.

Common Misconceptions About 1099-k’s

With thresholds, forms that only go out to some people, and the broad scope of payment platforms, there’s a lot of confusion about these forms and when they come into play. Let’s break down the most common misconceptions.

Misconception #1: If I don’t receive a 1099-k, I don’t need to report my income

The 1099-k is intended to make reporting income on taxes easier. However, even if you did not receive one, you still need to report your income.

Misconception #2: If I don’t meet the threshold, I don’t have to report my income

In most circumstances, you will still need to report your income. However, make sure you speak with a CPA to ensure you are not overpaying on taxes.

Misconception #3: You’ll get a Form 1099-k (and have to pay taxes) for Payments to and From Family and Friends for things like splitting the check at dinner.

Personal payments sent through platforms like Venmo, Zelle, and Paypal for things like dinner, travel, gifts, reimbursements, etc. should not be part of this form.

Misconception #4: You’ll be taxed on your total amount reported on form 1099-k

The form includes the total payments. However, your tax liability is determined by whether you sold your items at a loss or gain. You’ll need to work closely with your CPA to determine how much you owe.

Misconception #5: 1099-k’s are only for people who run resale businesses

Anyone who uses payment apps or sells through an online marketplace and surpasses the threshold will receive a 1099-k.

This information comes straight from the IRS. You can read their myths and facts about 1099-k’s here: IRS: Never mind the myths; know the facts about receiving a Form 1099-k.

You can also check out the IRS’s FAQs on this topic here: Form 1099-k FAQ

Help! I’m Still Confused About This Form and What To Do With It

If you’re still not sure whether to expect a 1099-k, what to do with it, or whether to report your income, know that you are not alone. The IRS confused so many people that it resulted in delaying a change to the threshold. If you need help, your best bet is to work with a CPA who can look at your individual circumstances and offer you tailored advice. Remember, everything you read on the internet (including in this blog) is general information and not tax advices. Each person’s tax scenario is different, and the best help you can get is from someone who knows your tax situation inside and out.

If you’re looking for a CPA who’s focused on tax savings and taking the stress out of tax season, contact us today.