Starting a business is an exciting and overwhelming experience. Understanding what tax deductions are available in your first year will help you avoid tax headaches and penalties, and set you up for success in year two.

Good practices in your first year is a great idea to ensure you are taking care of every aspect of your business.

In addition to your routine budgeting, tax deductions are often ignored. It offers a great opportunity to save your money and invest in the things that matter the most.

You can write off certain startup-related costs, however, the regulations are more complicated than those that apply to operational costs.

You need to be aware of which costs are deductible and how to claim them during tax season to comprehend how business beginning deductions function.

This article follows up with a detailed overview giving you ideas about the major tax deductions that you can cater in your first-year small business.

Moreover, these details will help you understand how you are supposed to set your business up for success in a couple of years.

What Are Tax Deductions And How Can You Claim These Deductions?

Tax deductions are expenses that self-employed business owners can write off from their taxable income. This is a highly likable way that could let you save money as it lowers the amount of tax that you must pay.

You can deduct a variety of items from your taxable income, such as business expenses, charitable contributions, and home office deductions.

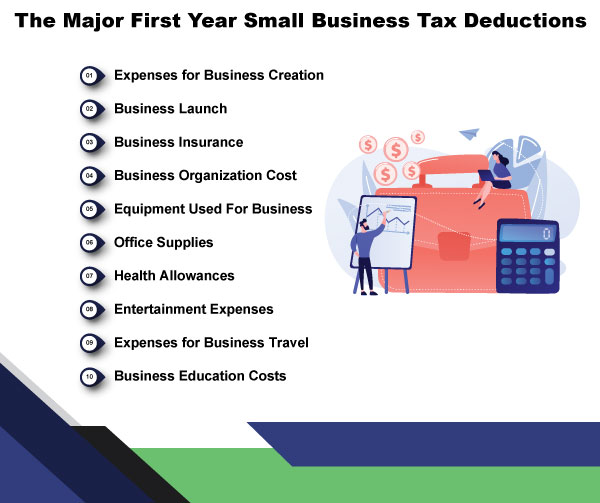

10 Major First Year Small Business Tax Deductions

It can be very motivating to start a new business.

Despite the enthusiasm that surrounds a startup, there are some expenses related to starting a new firm. Based on these expenses, you might be able to lower the amount of tax you pay.

The Internal Revenue Service (IRS) permits certain tax deductions for three distinct types of startup costs for businesses.

In the coming section of the article, we have mentioned some of the expenses that you may be able to deduct from your taxable income.

1 – Expenses for Business Creation

Business creation expenses include feasibility studies, market and product analyses, competition research, labor supply analysis, travel for site selection, and other expenses related to starting a new business.

These expenses are related to researching the formation of an active trade or business. You may able to deduct these expenses while filing your tax form.

2. Business Launch

This includes all expenses incurred to get your business up and running, such as those related to finding suppliers, hiring staff, training them, advertising, and professional fees.

Since equipment acquisitions are depreciated in accordance with standard business deduction laws, the associated costs are not included.

3. Business Insurance

The premiums you pay for a company insurance policy that is regular and necessary may be fully deducted from your income.

Other insurance products, such as life and disability insurance, are also maybe eligible for this deduction.

4. Business Organization Cost

These are the expenses related to forming your company as a corporation, limited liability company (LLC), or partnership, among other legal entities.

These expenses would include director fees, accounting fees, legal and state fees, as well as costs associated with holding any organizational meetings.

5. Equipment Used For Business

The entire cost of qualified new or used equipment may be written off from your gross income under IRS Section 179.

Short-term and long-term assets, as well as commercial software, are all eligible for this deduction if they are used exclusively for business purposes.

6. Office Supplies

If you buy printer ink, paper, or post-it notes for your company, you may deduct those costs from your revenue as an office expense.

This exclusion extends to the price of the used furnishings and equipment that are used in the office.

7. Health Allowances

First-year small businesses might be able to deduct some of the health insurance premiums paid by their employees from their earnings.

Monthly premium payments, tax-advantaged funds, donations to a health savings account (HSA), and other expenses may be eligible for these deductions.

Self-employed taxpayers may also be able to write off the premiums they spent on health, dental, and long-term care insurance for themselves and their families.

8. Entertainment Expenses

The expense of those meals and activities can be deducted from your business income if you entertain clients or potential customers to increase sales.

These credits are restricted to 50% of the cost and are only available if the entertainment was routine and required for conducting business.

9. Expenses for Business Travel

If it is regular, required, and takes place outside of the taxpayer’s home state, business travel tax deductions for work are fully deductible.

Plane tickets, parking and toll taxes, Uber, and hotel prices are a few examples of travel expenses.

10 – Business Education Costs

First-year small businesses that offer educational benefits to their workforce can deduct any related expenses.

The condition stands if it improves the abilities of their employees or adds value to the company.

Anything from continuing education to books about your field to courses meant to gain professional licenses can be deducted as a business expense for education.

5 First Year Small Business Expenses That Are a Must

For your business, you might incur some reasonable expenses. Unfortunately, not all of them are considered write-offs under the tax code.

This is the list of first-year small business expenses that are still not fully or partially deductible.

1. Government-Based Fines

No matter how much they are, governmental fines and penalties are typically not deductible.

2. Research Costs

You cannot deduct the money you spend analyzing potential company ventures. However, expenses that are considered start-up costs can, up to a certain point, be written off as company expenses during the first year of business.

3. Interest on Significant Payments

Owners of pass-through corporations and sole proprietorships may not be permitted to deduct interest on tax underpayments. Even though the interest relates to commercial income, it is still considered personal interest.

4. Employees’ Commuting Costs

Moving fee reimbursements and commuting cost reimbursements (such as free parking and monthly transit passes) may not tax deductible.

5. Personal Commute Expenses

You may not be able to deduct the cost of transportation, regardless of how time-consuming, expensive, or tough it is for you to go between your place of business and home.

Conclusion

It is much more difficult to write off starting costs than it is to deduct business expenses. This is especially true once your company has started operating.

It is always critical to speak with a tax counselor who specializes in small business taxation, even if you think you understand the process well enough to get by on your own.

Getting professional help can assist you in overcoming any challenges so that you file your taxes correctly.