3 Key Takeaways from the First Half of 2023

Reading Time: 2 minutesAs next we enter the final 5 months of the year, it’s important to reflect on what the first half of 2023 has entailed, what

All of the information you need, right here, right now.

Reading Time: 2 minutesAs next we enter the final 5 months of the year, it’s important to reflect on what the first half of 2023 has entailed, what

Reading Time: 3 minutesIf there’s anything the internet has provided us with, it’s seemingly infinite options. Type “local CPA near me” into any search platform and you are

Reading Time: 4 minutesThere are three main tiers of businesses in the United States: Small Businesses, Mid-Sized Businesses, and Enterprise Level Businesses. Each category is typically determined by

Reading Time: 3 minutesManaging your business or personal finances can get complicated quickly, and it’s common for individuals and businesses to reach a point where they realize they

Reading Time: 2 minutesTechnically, yes. But, there are some limitations. When Bookkeepers Do Tax Returns Bookkeepers have an important role in tax preparation, and not just during tax

Reading Time: 2 minutesAccounting is a critical function in any business, and having a solid accounting strategy is essential for the success of the organization. An accounting strategy

Reading Time: 3 minutesSelf Employment Tax Vs Income Tax

Reading Time: 3 minutesIf you are a business owner, then you have to pay your employees. This means that you have to worry about payroll taxes. These taxes

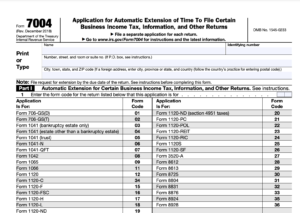

Reading Time: 3 minutesAn important note: depending on the type of extension you are looking to file, you may need to submit additional forms. We highly recommend speaking

Reading Time: 5 minutesThe IRS received over $4.1 trillion in tax revenue in 2021. If you don’t pay the full amount owed on your taxes, you will be

Reading Time: 4 minutesAny improvement that significantly increases the value of your home and extends its useful life is considered a home improvement. If you tear down your

Reading Time: 4 minutesThe IRS has millions of tax refunds to process, which is why it could take longer than expected to get your refund. The IRS usually

Reading Time: 4 minutesA CPA provides expertise in the financial industry. Businesses often hire them to manage tax planning, financial forecasting, and defending any issues in front of

Reading Time: 3 minutesThe short explanation lies in the statement all CPAs are accountants, but not all accountants are CPAs. While it’s easy to get the two confused,

Reading Time: 5 minutesIf you don’t file your taxes on time, you will be liable to pay penalties in addition to the taxes you owe. This statement may

Reading Time: 4 minutesEach tax season, many business owners and individuals discover they owe the IRS late filing penalties and/or late payment penalties. But, more often than not,

Reading Time: 5 minutesFiling your tax returns can be a very overwhelming process. The situation can add to the complexity when you file an extension for your tax

Reading Time: 3 minutesWith inflation going up, people get pushed into higher income tax brackets as well. To regulate the impact of inflation, the income tax bracket gets

Reading Time: 3 minutesAs the new year is approaching, the deadline to file your tax for 2023 is near. It is estimated that the IRS starts accepting tax

Reading Time: 7 minutesEvery year thousands of Canadian move to the U.S. for work, personal, and business purposes. Unlike the U.S., Canada has unique rules for filing a

Reading Time: 4 minutesWith the right tax strategy, your business can avoid paying a sizable sum of taxes to the government. Companies that heavily invest their thought processes

Our CPAs build an accounting process that is modern, efficient, and has the reporting capabilities you need.

Regular reports ensure you get the oversight you need to be comfortable, without being involved in the day-to-day.

Easily submit any documents remotely through our secure online portal, and we’ll take it from there.

We believe in building strong, long-term client relationships, holding ourselves to a high standard of accountability when it comes to client work, providing excellent communication, and receiving ongoing feedback from our clients.

With unparalleled guidance, cost-saving entity structures, and forecasting built on experience, you’ll get the benefit of CPAs that know the ins and outs of how your industry works.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

Maintain a complete picture of your transaction history and financial health. Our team adheres to strict accounting standards, ensuring accurate and up-to-date books with a financial trail that is straightforward and easy to follow.

Our bookkeeping and accounting reports offer a detailed and accurate look at the complete financial health of your business. From regular reports to real-time insights, our approach to accounting is always data-driven

Unlock the full power of your accounting software with a fully-integrated software setup. Ensure regular and easy instant-generated reports with unquestionable accuracy in every line item

Regular tracking and management combined with inventory audits, evaluations, and reports help you optimize your inventory levels, track performance, and make critical decisions

Get paid on time and stay up to date with vendor payment with invoicing services focused on accuracy, timeliness, and strategy. Our team implements tools and approaches that ensure accounts payable and accounts receivable are in good health

Payroll services from the top down means your business gets the labor reports it needs while your employees and contractors are paid on time. Our team follows regulations and focuses on accuracy, offering well-rounded payroll services to the highest standard.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

For assistance in planning and transferring your U.S. assets to Canada, please contact our colleague Phil Hogan, CPA, CA, CPA at (250) 661-9417 or phil@philhogan.com