Employee benefits accounting involves complex documentation, financial planning, and specific rules and regulations to adhere to. We have gathered some general advice to deal with these challenges.

What follows is general information. For specific advice related to your company’s financials, it’s extremely valuable to talk with an experienced CPA.

How to Calculate Employee Benefits Expenses

Before determining the cost of employee benefits, you must know which benefits you are going to provide. Since each benefit affects your accounting differently, you will have to run multiple calculations in order to measure its impact.

Below are some of the popular employee benefits:

- 401(k) Plan

- Retirement Contributions

- Gym Allowances

- Health Insurance

- Flexible Spending Accounts or Health Savings Account

- Paid Vacation

- Paid Holidays

- Bereavement Leave

- Continuing Education Assistance

- and more

Once you have decided on the employee benefits, the next step will be to determine the cost of these benefits to your business. There are two methods you may follow to calculate your expenses for employee benefits: direct costs and accrual accounting.

Also Read: How Employee Classification Affects Your Payroll

Method 1: Determining the Direct Costs

The direct cost determines the overall costs a company will bear on its financials by measuring the total expense of providing those benefits.

If you are spending a total of $10,000 annually for employee benefits with $80,000 annual compensation, the total percentage that goes for employee benefits will be: ($10,000/$80,000)*100 = 12.5%

This means that the employee will get 12.5% of his/her annual compensation additional through employee benefits.

This further implies that means an employee is costing you $7,500 per month with all the benefits instead of $6,666 (monthly compensation).

[CP_CALCULATED_FIELDS id=”8″]

Method 2: Accrual Accounting

One of the most used methodologies for allocating the cost of employee benefits is the accrual method. Under this method, the expense is recognized even though there is no supplier invoice.

For instance, you have promised to provide provident funds to an employee when he/she leaves an organization. The company will hand over this amount when the tenure of an employee ends, however, the financial records will show that they have been deducted from each month when the employee serving in the company.

Most companies use accrual accounting to determine the insurance and pension liabilities on their financial reports.

Employee Benefits Accounting

There’s a huge list of benefits that a company can choose for its employees. Since each company chooses different benefits for its employees, the implication on its finances may have variations depending upon the benefits.

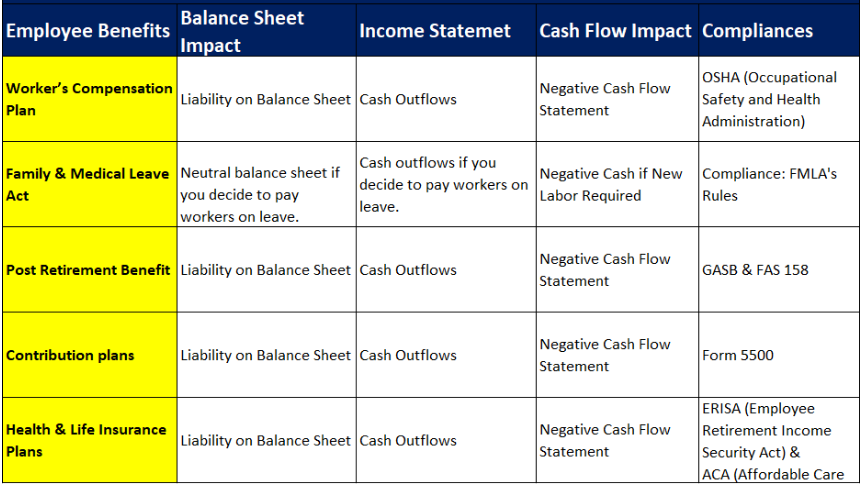

In the coming section, we have listed some of the popular benefits a company chooses for its employee and how it affects the financial statements of the company.

1. Worker’s Compensation Insurance Plan

An insurance policy is known as a workers’ compensation plan that offers benefits to workers who are hurt on the job or fall ill as a result. This is often covered under liability insurance.

This plan may have the following effects on your accounting procedure:

- Balance Sheet

The expected cost of providing benefits to workers who are injured on the job or fall ill would be a liability.

- Income Statement

The expense for workers’ compensation insurance will appear on your company’s income statement. Typically, this is listed as an expense under employee benefits.

- Cash Flow Statement

In the cash flow statement, the premiums paid for workers’ compensation insurance will be listed as cash outflows.

- Compliance

When it comes to workers’ compensation insurance, there are a number of rules that must be followed, including state regulations and OSHA (Occupational Safety and Health Administration) requirements. Talk with an experienced accountant to know more about these legalities.

2. Family and Medical Leave Act

Federal legislation known as the Family and Medical Leave Act (FMLA) mandates that businesses give eligible workers up to 12 weeks of unpaid, job-protected leave each year for specific family and medical reasons.

The FMLA may have the following effects on your accounting procedure:

- Income Statement

Employers are not required to pay their workers for leave under the FMLA, although they are free to do so.

To appropriately record employee benefits on the income statement, employers must keep track of how much time off workers take and how much money is given, if any.

- Compliance

Employers are required to abide by the FMLA’s rules, which include informing workers of their legal rights and keeping specific records.

- Record Keeping

For a minimum of three years, employers are required to keep records of any FMLA leaves taken by their employees.

This covers the duration of the leave, the justification for it, and any documentation supporting its medical or familial necessity.

With proper records, you may find it easy to fight a legal battle if you are faced with any of them.

- Labor costs

If an employee takes a leave of absence, the employer may incur higher labor costs, such as employing a temporary worker or paying overtime to other employees. This may have an effect on the costs and profitability of the business.

3. Post Retirement Benefit

Pensions and retiree health insurance are two post-retirement advantages that can significantly affect a company’s financial reports and accounting.

Post-retirement benefits may influence your accounting procedure in the following ways:

- Balance Sheet

Post-retirement benefits may result in the rise of liabilities. A liability for the anticipated future benefit payments to retirees will appear on your company’s balance sheet if your business has a defined benefit plan, such as a pension plan.

- Income Statement

If your firm offers a defined benefit plan, the cost of the plan, which is calculated by an actuary using assumptions about future retiree benefit payments, interest rates, and other factors, will appear as an item on your company’s income statement.

- Compliance

Offering post-retirement benefits is subject to a number of laws and regulations, including GASB 68 and FAS 158.

Since a CPA spends years maintaining compliance, we’d highly recommend spending some time for a consultation with him/her.

4. Contribution plan – 401 (k)

An example of a defined contribution plan is a 401(k), which allows employees to contribute before taxes to a retirement account. Additionally, the employer has the option to fund the plan on the employee’s behalf.

A 401(k) plan can influence your accounting procedure in the following ways:

- Balance sheet

Your obligations will rise on your balance sheet as a result of a 401(k) plan. The sum of money set aside in the plan for employees would be counted as a liability. - Income Statement

The costs associated with your company’s contributions to the employee benefit plan will appear as an expense under the employee benefits section. - Compliance

A publicly available Form 5500 goes out to the IRS and Department of labor. You may need additional compliances as well, talk with an experienced accountant to more about these legalities.

5. Health & Life Insurance Plans

The financial statements and accounting of a corporation may be significantly impacted by health and life insurance plans.

Following are some of the areas you may need to focus on in order to maintain a check on your accounting.

- Balance sheet

The expected sum of money that would be distributed to employees as benefits for health or life insurance claims would be the liability.

- Income Statement

Health and life insurance plan premium payments will be shown as cash outflows in the operating activities section.

- Compliance

When it comes to health and life insurance plans, there are a number of rules that must be followed, including the ERISA (Employee Retirement Income Security Act) and ACA (Affordable Care Act) regulations. It is always necessary to consult with a professional CPA in order to understand compliance issues.

Conclusion

Employee benefits accounting is a complex and important area of accounting that involves the proper recognition and reporting of the costs associated with providing benefits to employees. However, these are very generic pieces of advice that a business owner needs to maintain.

We highly recommend consulting with a professional accountant or financial advisor for specific advice on accounting for employee benefits.