Keeping records of your sales, purchases, and expenses is not only a good business practice, it’s essential. Your receipt and record keeping practices impact every aspect of your business: paying invoices and getting paid, assessing company growth and making key financial decisions, filing your taxes on time and accurately, tendering payroll, maximizing tax deductions, auditing, and so much more.

Your entire system can easily fall into disarray as a result of bad record-keeping. Imagine the IRS or any federal institute asking to submit the record of your previous year’s financials, and not being able to find (or not even having) the right documents.

According to a study, in the U.S. alone, we have around 4 trillion paper documents. That number grows at a rate of 22% yearly. Keep reading to learn best practices for maintaining records.

Keep Separate Business and Personal Bank Accounts

Maintaining separate business and personal accounts helps you avoid the hassle of organizing business financial statements at a later date.

It is advised to keep separate personal and business accounts so that your respective expenses are recorded separately. This eliminates room for error and potentially miscategorizing a personal expense as a business expense.

This also:

- Makes tracking business cash flow more efficient

- Protects assets from personal liabilities (in some cases)

- Improves budgeting and forecasting abilities

- Helps you maximize tax benefits

- Gives you a credible company image

This best practice is all about efficiency and accuracy.

Retain Paper and Digital Records

While paper copies may seem sufficient, digital records ensure that your documents are backed up in the event of a fire, flood, or general loss of your paper records. This typically comes into play with paper receipts from purchases made for your business. Some businesses upload and log expense receipts daily, while others do so monthly or quarterly.

Digital records should be kept for:

- Purchase receipts

- Invoices

- Payroll stubs

- Business formation and standing documents

- All other documents

Most businesses are advised to keep digital records either in cloud-based accounting software, safely stored on a drive in a fireproof box, or in a secondary location. For most people, this means submitting their records through their CPA’s accounting system portal.

There are some documents that a business must always keep on hand like financial statements, business permits, articles of incorporation, and a company’s regulatory documents. Most accounting platforms offer the option of receipt storage and upload as well.

For example, if we look at 2021 and 2020 stats, most of the business owners filed their taxes electronically because it gives them the flexibility to easily submit their records.

Use Accounting Software to its Full Capabilities

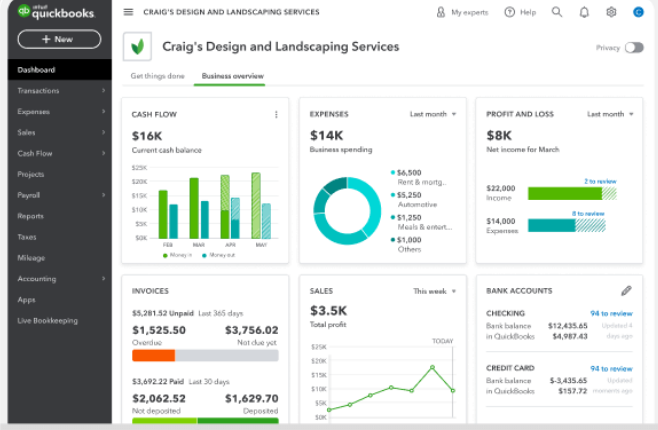

One of the best things you can do for your business is using accounting software correctly and to its full capabilities.

You can use accounting software for:

- Storing receipts

- Logging expenses

- Generating invoices

- Logging payments

- Payroll* (can be part of your accounting software or a separate software)

- Generating reports

- Reconciling Bank Statements

- Monitoring Cashflow and Performance

When used properly, accounting software can become your go-to source for record keeping and force you to maintain best practices for your businesses. Because these programs are designed around the needs and guidelines for businesses, CPAs, and the IRS, they automate many processes and generate and store helpful records.

This means documents and reports can be found quickly and efficiently, and it can be the difference between spending a month in DIY spreadsheets finding documents and amounts, and generating a report in a few clicks.

If you use accounting software, generating and maintaining quarterly and yearly reports is a great practice.

Backup Your Business Records

Every business should keep a backup of their records. This can be a secure cloud backup drive or physical copies at a second physical location. Even if you submit your records to a CPA, maintaining your own records and backups is advised.

Reconcile Your Bank Statements

Bank statement reconciliation is typically done on a monthly basis, though some businesses with low transaction rates will do so quarterly. The goal of this process is to find any discrepancies and ensure that the transactions you’ve recorded are accurate. Most accounting software allows business transactions to be recorded with supporting documents, and many CPAs will have a portal where you can upload statements for reconciliation.

When reconciling your bank statement, you will want to check for:

- Duplicate transactions

- Incorrect transaction amounts

- Inconsistencies in bank records

- Canceled checks and transaction credits

- Any errors

While following this process, double-check the entries’ receipts records with supporting documents. The bank reconciliation process is always easier if you are up-to-date on your other record keeping practices.

Maintain Tax Records for at Least Three Years

It is recommended to keep all of your filed tax records and supporting documents for a minimum period of three years.

Tax records you must maintain include:

- W-2 (Wage and Tax Statement)

- Business Travelled Miles

- Deductions

- Credits

- Form 1099’s (Used for Reporting Non-Employment income to the IRS)

- Filed Tax Forms

- Invoices

This is useful as evidence if you are ever faced with an audit, or if the IRS requests further information for your taxes. Following a system and maintaining appropriate and accurate financial records on an ongoing basis will help ease your tax preparation process and ensure your information is easy to find.

Follow the IRS Document Lifecycle for Record Keeping

It is crucial to understand the life cycle of different documents for record keeping. While some documents must only be retained for three years, the IRS requires businesses to keep records of some documents for at least 7.

Records required by the IRS for businesses to maintain for 7 years:

- Business financial statements

- Employee credentials (Name, Address, Phone)

- Bank statements

- Tax forms submitted

- Contracts, including loans and mortgages

- Purchase receipts

- Customer invoices

- Business registration documents

The time frame can be more or less adjusted according to the circumstances. For instance, financial statements must be kept for more than 7 years, while medical bill receipts typically need to be kept for 1 year.

There may be a broad list of other documents as well depending upon the category of business you operate in. It is advised to take a quick consultation with an experienced CPA to know about these details.

You can learn more about these limits here: lifecycle of a document by the IRS.

Use Payroll Software for Issuing and Reporting

Payroll software automates many elements of the process and can store and generate helpful records. While it’s important to generate and save reports for your fiscal year and quarters, when used properly, you can use this software to generate reports for any time period. Whether it’s you or a CPA searching, the necessary documents and reports can be found quickly.

In addition to Quickbooks, there are a number of software options that can be used. For instance, Shoeboxed (accounting software) can help you maintain customer invoices and accounts receivable automatically when a transaction occurs.

If your business uses payroll software then it must have documents like W-2, and W-3. 1099-MISC, 1099-NEC forms along with form 941.

If a CPA is searching for such records, they will know exactly where to find them. This saves time and money for both parties: the auditor and the management.

Work with a Third Party CPA

A third-party CPA can guide you and ensure you are maintaining records for the correct time periods. This can also reduce your liability and improve efficiency, which is an important part of the painstaking process of record keeping.

When it comes to record-keeping, a CPA can help with:

- Maintaining records

- Receipt storage and documentation

- Generating reports

- Accounting software cleanup

- Payroll issuance and reports

- Filing taxes

- IRS communications and audits

- and, more.

Ready for the help of a CPA?

Talk with an experienced CPA today if you are concerned about your records and ready to get things under control. Consider an accounting software clean-up, ongoing accounting and payroll services, and a one-on-one consultation for your business.