Below you will find a list of recommended weekly bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to post near your computer:

Weekly Bookkeeping Checklist Download

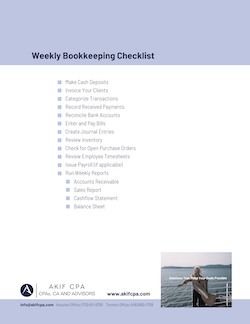

Weekly Bookkeeping Checklist

- Make Cash Deposits (details)

- Invoice Your Clients (details)

- Categorize Transactions (details)

- Record Received Payments (details)

- Reconcile Bank Accounts (details)

- Enter and Pay Bills (details)

- Create Journal Entries (details)

- Review Inventory (details)

- Check for Open Purchase Orders (details)

- Review Employee Timesheets (details)

- Issue Payroll (if applicable) (details)

- Run Weekly Reports (details)

- Accounts Receivable

- Sales Report

- Cashflow Statement

- Balance Sheet

Of course, there may be additional tasks depending on your business, and some of these may not apply to you. This is a general guideline, so be sure to consult with your CPA or your in-house team to confirm what is necessary for you.

More checklists:

Detailed Weekly Bookkeeping Tasks

Make Cash Deposits

Deposit any cash to ensure all accounts are up to date and accurate, and that you have the funds to cover coming expenses.

Invoice Your Clients

Generate and issue invoices to clients, verifying amounts, deadlines, late fees, and where to send the invoice.

Categorize Transactions

Categorize all transactions to ensure they match up with the appropriate category. For expenses, this can include things like payroll, employee benefits, office supplies, utilities, rent payments, insurance, equipment, travel, etc.

Record Received Payments

Record any payments received and mark invoices as paid in your accounting software.

Reconcile Bank Accounts

Check to make sure that receipts, inputs, and your ledger match your bank account’s transaction log.

Enter and Pay Bills

Pay any bills, logging payment and to whom and marking transactions appropriately.

Create Journal Entries

Journal entries are meant to accompany financial transactions and generate a chronological record. This can involve assets, liabilities, equity, revenue, and expenses.

Review Inventory

Weekly inventory review helps your team determine how much needs to be ordered, as well as any sales trends. It’s also key to identifying potential theft, losses, and errors quickly.

Check for Open Purchase Orders

Orders that are in process but haven’t yet been invoiced will ensure your understanding of expenses will be accurate. Sometimes delays, partial fulfillment, and backorder can affect a purchase order.

Review Employee Timesheets

Review employee timesheets and reconcile hours in preparation for payroll.

Issue Payroll (if applicable)

If you issue payroll bi-weekly or on receipt of invoice (for 1099 independent contractors), or monthly and it is a payroll week, make sure you issue payroll.

Run Weekly Reports

Weekly reports will be set typically by your company’s financial team. This can mean a cash on hand report, sales report, balance sheet, and more.