Below you will find a list of recommended year-end bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to post near your computer:

Year-End Bookkeeping Checklist Download

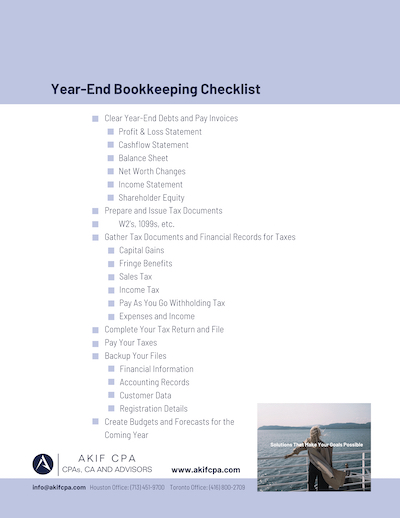

Year-End Bookkeeping Checklist

- Clear Year-End Debts and Pay Invoices (details)

- Run Year-End Reports (details)

- Profit & Loss Statement

- Cashflow Statement

- Balance Sheet

- Net Worth Changes

- Income Statement

- Shareholder Equity

- Prepare and Issue Tax Documents (details)

- W2’s, 1099’s, etc.

- Gather Tax Documents and Financial Records for Taxes (details)

- Capital gains

- Fringe benefits

- Sales tax

- Income tax

- Pay as you go withholding tax

- Expense reports

- Complete Your Tax Return and File (details)

- Pay Your Taxes (details)

- Backup Your Files (details)

- Financial Information

- Accounting Records

- Customer Data

- Registration Details

- Create Budgets and Forecasts for the Coming Year (details)

Of course, there may be additional tasks depending on your business, and some of these may not apply to you. This is a general guideline, so be sure to consult with your CPA or your in-house team to confirm what is necessary for you.

More checklists:

Detailed Year-End Bookkeeping Tasks

Clear Year-End Debts and Pay Invoices

Pay any outstanding invoices and any debts that must be cleared by the end of the year. Many companies will also take this opportunity to make any large expenses needed for day to day operations.

Run Year-End Reports

Your year-end reports should be comprehensive and cover all financial aspects of the business. These can be utilized to understand the year’s performance, forecast for the future, make critical decisions about inventory and services, and serve as the framework for the coming year’s budgeting. It can also be useful for determining things like employee bonuses.

Consider the following reports:

- Profit & Loss Statement

- Cashflow Statement

- Balance Sheet

- Net Worth Changes

- Income Statement

- Shareholder Equity.

There may be other beneficial reports for your business. Be sure to check with your team and a qualified CPA.

Prepare and Issue Tax Documents

Timely issuing of any tax documents is critical not just for employees, but for following IRS regulations and tax obligations. You will need to calculate and issue any tax documents your employees require in order to file, including W2’s and 1099s.

Gather Tax Documents and Financial Records for Taxes

Gather all tax documents and financial reports you will need for filing your taxes. This will typically include:

- Your P&L Statement

- Expense List and Reports

- Categorized Transaction History for the Year

- Capital Gains

- Fringe Benefits

- Sales Tax Paid and Reported

- Income Tax Paid and Reported

- Pay As You Go Withholding Tax

Most businesses will have additional reports required. Speak with your CPA for direct guidance on what information you must provide.

Complete Your Tax Return and File

Just like every year, you will need to begin the labor of completing your tax return and filing. Luckily, if you’re working with a CPA, this process can be much more straightforward (particularly if you’re utilizing outsourced accounting).

Pay Your Taxes

Remember that filing and paying your taxes are two different steps and failure to do either has its own consequences. Make sure you pay on time in order to avoid penalties.

Backup Your Files

Since the IRS requires you to retain records, and because it is good business practice, be sure to back up all of your files, including receipts and financial information, employee and accounting records, customer data, registration details, and any other relevant documents.

Create Budgets and Forecasts for the Coming Year

Utilizing the year-end financial reports you’ve generated, it’s time to get with your team and build your budget and forecast for the coming year. It’s instrumental that you, as the bookkeeper or in-house accountant are prepared to make adjustments based on decisions about inventory, changes to services, employee benefits, and any fiscal changes for the coming year.