What to Do if Your Accountant Makes a Mistake

Reading Time: 4 minutesAs in any business process, sometimes mistakes in accounting creep up. Even the most professional, focused, and reliable accountants are not completely error-proof. If you

All of the information you need, right here, right now.

Reading Time: 4 minutesAs in any business process, sometimes mistakes in accounting creep up. Even the most professional, focused, and reliable accountants are not completely error-proof. If you

Reading Time: 4 minutesThere’s plenty of guidance out there for switching accounting software, most of which comes from software providers themselves. But, what do we as CPAs and

Reading Time: 3 minutesBookkeeping plays a critical role in accounting. Ensuring your financial records are accurate and organized helps your company make better financial decisions, assists with evaluating

Reading Time: 5 minutesSmall businesses often face numerous challenges when it comes to managing their finances. They have to ensure that their accounting records are accurate and up-to-date,

Reading Time: 3 minutesWhy do small businesses outsource their accounting services? It’s simple. Accounting is a time-intensive, risk- and error-prone element of running a business that impacts everything

Reading Time: 2 minutesAccounting is a critical function in any business, and having a solid accounting strategy is essential for the success of the organization. An accounting strategy

Reading Time: 3 minutesAn integral role of a CPA (Certified Public Accountant) is risk management and assessments for their clients. While Risk Management is necessary across departments, when

Reading Time: 2 minutesOf the many things we enjoy collaborating with our clients on, one of our big services is bookkeeping and accounting. Our team works together to

Reading Time: 5 minutesThe General Ledger can be a mystery for business owners without a background in finance and accounting, or who are running small businesses. Let’s walk

Reading Time: 4 minutesThere are many common accounting services available for small businesses, and some offerings you may not be aware of. Whether you’re looking for help with

Reading Time: 2 minutesBelow you will find a list of recommended weekly bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to

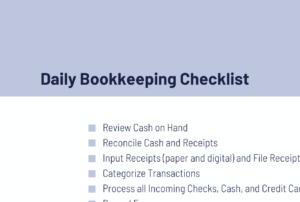

Reading Time: 3 minutesBelow you will find a list of recommended daily bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to

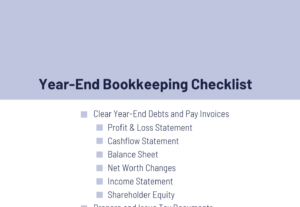

Reading Time: 3 minutesBelow you will find a list of recommended year-end bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to

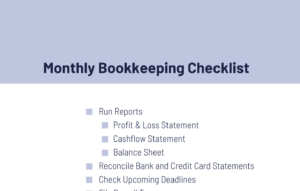

Reading Time: 2 minutesBelow you will find a list of recommended monthly bookkeeping tasks. You can bookmark this page for later reference, or download our printable version to

Reading Time: 4 minutesWhether it’s issuing invoices, logging expenses and reconciling bank statements, or identifying errors, bookkeepers play a critical role in the success of any business. Many

Reading Time: 3 minutesAs business owners face more and more pressure to sustain through a shaky economy, many are realizing their current bookkeeping strategy is not longer tenable.

Reading Time: 6 minutesBusinesses of all sizes require expert financial management to succeed. Deciding whether to hire an in-house accountant or an accounting consultant can be challenging. In

Reading Time: 4 minutesYear-end financial statements provide a detailed summary of a company’s financial performance. 60% of small business owners review their year-end financial statements for strategic decision-making.

Reading Time: 5 minutesBookkeeping involves dealing with a lot of numbers, which is why it is advised to establish routine checks for your accounting books to avoid anomalies.

Reading Time: 4 minutesAccounting clerks and bookkeepers both contribute to the management of a company’s financial records and share the responsibility for documenting, confirming, and reporting business transactions.

Reading Time: 4 minutesIt’s always a good idea to conduct random audits of your company’s financial books to make sure that your company’s data is stored in the

Our CPAs build an accounting process that is modern, efficient, and has the reporting capabilities you need.

Regular reports ensure you get the oversight you need to be comfortable, without being involved in the day-to-day.

Easily submit any documents remotely through our secure online portal, and we’ll take it from there.

We believe in building strong, long-term client relationships, holding ourselves to a high standard of accountability when it comes to client work, providing excellent communication, and receiving ongoing feedback from our clients.

With unparalleled guidance, cost-saving entity structures, and forecasting built on experience, you’ll get the benefit of CPAs that know the ins and outs of how your industry works.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

Maintain a complete picture of your transaction history and financial health. Our team adheres to strict accounting standards, ensuring accurate and up-to-date books with a financial trail that is straightforward and easy to follow.

Our bookkeeping and accounting reports offer a detailed and accurate look at the complete financial health of your business. From regular reports to real-time insights, our approach to accounting is always data-driven

Unlock the full power of your accounting software with a fully-integrated software setup. Ensure regular and easy instant-generated reports with unquestionable accuracy in every line item

Regular tracking and management combined with inventory audits, evaluations, and reports help you optimize your inventory levels, track performance, and make critical decisions

Get paid on time and stay up to date with vendor payment with invoicing services focused on accuracy, timeliness, and strategy. Our team implements tools and approaches that ensure accounts payable and accounts receivable are in good health

Payroll services from the top down means your business gets the labor reports it needs while your employees and contractors are paid on time. Our team follows regulations and focuses on accuracy, offering well-rounded payroll services to the highest standard.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

For assistance in planning and transferring your U.S. assets to Canada, please contact our colleague Phil Hogan, CPA, CA, CPA at (250) 661-9417 or phil@philhogan.com