Where to Download Paypal, Ebay, and Other E-Commerce Tax Forms

Reading Time: 3 minutesIt’s important to download and gather all of your e-commerce tax documents, including 1099-ks, VAT, sales tax reports, and sales statements to bring to your

All of the information you need, right here, right now.

Reading Time: 3 minutesIt’s important to download and gather all of your e-commerce tax documents, including 1099-ks, VAT, sales tax reports, and sales statements to bring to your

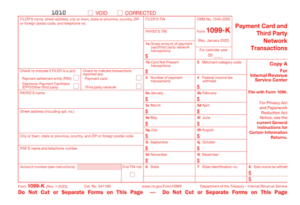

Reading Time: 4 minutesIn this article, we outline what a 1099-k is, how selling through online marketplaces and exchanging money through payment platforms impacts your taxes, and common

Reading Time: 3 minutesThe IRS has begun issuing “Get Ready” alerts, to remind all US taxpayers that time is running out to make changes to 2023 income and

Reading Time: 4 minutesFiling and paying your payroll tax returns on time is important for keeping your business in good standing with the IRS, fulfilling your tax obligations,

Reading Time: < 1 minuteThe federal tax filing extension deadline is upon us. If you requested an extension for filing your 2022 tax return, you have just a little

Reading Time: 4 minutesYou’re running an e-commerce business. You’ve set up your store(s), ensured sales tax is administered appropriately, set up your initial shipping fees, and added your

Reading Time: 2 minutesTechnically, yes. But, there are some limitations. When Bookkeepers Do Tax Returns Bookkeepers have an important role in tax preparation, and not just during tax

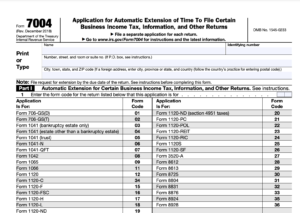

Reading Time: 3 minutesAn important note: depending on the type of extension you are looking to file, you may need to submit additional forms. We highly recommend speaking

Reading Time: 5 minutesIf you are a Canadian and running an e-commerce business in the U.S., you are subject to pay different taxes depending upon your activity in

Reading Time: 4 minutesThe IRS has millions of tax refunds to process, which is why it could take longer than expected to get your refund. The IRS usually

Reading Time: 4 minutesEach tax season, many business owners and individuals discover they owe the IRS late filing penalties and/or late payment penalties. But, more often than not,

Reading Time: 5 minutesFiling your tax returns can be a very overwhelming process. The situation can add to the complexity when you file an extension for your tax

Reading Time: 4 minutesWith the right tax strategy, your business can avoid paying a sizable sum of taxes to the government. Companies that heavily invest their thought processes

Reading Time: 7 minutesLearn the difference between annual tax payments and quarterly 1040-E estimated taxes, and cases in which you should file each way

Reading Time: 7 minutesIf your current CPA is disorganized, they miss deadlines, aren’t providing you with reports, and don’t have expertise in your industry, it might be time to switch

Reading Time: 5 minutesIf you want to expand your e-commerce overseas, make sure you understand cross-border operations and taxes

Reading Time: 6 minutesLearn about the tax implications of selling products in Canada, how to avoid tax errors and penalties, and more

Reading Time: 4 minutesRegulatory reform, social buying, diverse video content sales, food and grocery delivery, digital audio

Reading Time: 3 minutesWrite off travel, marketing, inventory, payroll, and claim deductions for your content creation career

Reading Time: 4 minutesHelpful table with sales tax types and rates by Canadian province (Good Services Tax, Provinicial Retail Sales Tax, Harmonised Sales Tax, Quebec Sales Tax)

Reading Time: 3 minutesGet better financial management, business support, tax compliance, and more from an e-commerce tax consultant.

Our CPAs build an accounting process that is modern, efficient, and has the reporting capabilities you need.

Regular reports ensure you get the oversight you need to be comfortable, without being involved in the day-to-day.

Easily submit any documents remotely through our secure online portal, and we’ll take it from there.

We believe in building strong, long-term client relationships, holding ourselves to a high standard of accountability when it comes to client work, providing excellent communication, and receiving ongoing feedback from our clients.

With unparalleled guidance, cost-saving entity structures, and forecasting built on experience, you’ll get the benefit of CPAs that know the ins and outs of how your industry works.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

Maintain a complete picture of your transaction history and financial health. Our team adheres to strict accounting standards, ensuring accurate and up-to-date books with a financial trail that is straightforward and easy to follow.

Our bookkeeping and accounting reports offer a detailed and accurate look at the complete financial health of your business. From regular reports to real-time insights, our approach to accounting is always data-driven

Unlock the full power of your accounting software with a fully-integrated software setup. Ensure regular and easy instant-generated reports with unquestionable accuracy in every line item

Regular tracking and management combined with inventory audits, evaluations, and reports help you optimize your inventory levels, track performance, and make critical decisions

Get paid on time and stay up to date with vendor payment with invoicing services focused on accuracy, timeliness, and strategy. Our team implements tools and approaches that ensure accounts payable and accounts receivable are in good health

Payroll services from the top down means your business gets the labor reports it needs while your employees and contractors are paid on time. Our team follows regulations and focuses on accuracy, offering well-rounded payroll services to the highest standard.

Get 360° accounting services that offer full support and coverage of every aspect of your business.

We offer everything from granular, data-entry support to high level accounting strategy. Don’t see the service you need listed? Just ask!

For assistance in planning and transferring your U.S. assets to Canada, please contact our colleague Phil Hogan, CPA, CA, CPA at (250) 661-9417 or [email protected]